ADBE - A Great Business At A Fair Price (1/2)

With solid execution for years, ADBE continues to be a good investment opportunity for investors looking for high certainty, low volatility names.

Summary

This is Part 1 of a two-part research report.

We think potential investors should consider Adobe’s culture, and to assess that we’ve decided to review Adobe’s key milestones during its history.

We also take a look at Adobe’s three-pronged cloud strategy and consider the biggest future growth drivers.

Part 2 will consist of financial and valuation analysis

Executive Summary

Over its 40-year history, Adobe has cultivated an impressive pedigree with various industry-defining innovations related to publishing.

Adobe appears to have long developed a Kaizen-like culture that is unwavering in its quest to remain the industry standard is various areas across the publishing domain.

CEO Shantanu Narayen has led Adobe to achieving one of the smoothest SaaS transitions and it has become a textbook example for other firms to follow.

In the past 10 years, Adobe has expanded into markets outside of the creative publishing space, however, they have proven to be highly synergistic - providing users, teams, and enterprises with an end-to-end solution covering content creation, work management, and CX management.

Adobe has a vast product range but unlike other tech giants, the strategy still appears laser focused – each and every product funnels down into helping its customers excel amid the ongoing digitalization.

Future growth drivers for Adobe are the flourishing creator economy and the vast greenfield space of the metaverse.

We expect Narayen to be as accurate in his vision for, and Adobe’s role within, the metaverse, as he was in the early cloud days.

As we’ll publish along with other financial analysis in Part 2, according to our valuation Adobe isn’t trading at a heavy discount but we consider it a great business at a fair price for long-term investors.

About This Report

Big tech companies like Microsoft, Google, Apple, and Meta, need no introduction because most of society uses them everyday and their history is well-known. Adobe could be categorized as big tech, though it’s our sense that, whilst they are a well-known name, an understanding of what they’ve pioneered in the tech industry over its 40-year history is probably less common among investors.

At the same time, given the sheer breadth of Adobe’s suite of products, in our opinion briefly introducing what they do – i.e., Adobe offers a broad, end-to-end platform for the creation and publication of a wide range of content, including graphics, photography, illustration, video, animation and more – doesn’t encapsulate what an investor needs to know if they’re considering a long-term investment.

Furthermore, if investors want to think deep about Adobe’s future prospects as we move further into the era of the metaverse and Web 3.0, it would be extremely helpful to have a solid understanding of their illustrious history. This is why in the following section, we’ve decided to review Adobe’s timeline from the inception of the company. Personally, we’ve found this historical review quite enlightening and it should give readers an insight into the level of innovation and focus that is infused in Adobe’s culture. And ultimately, it’s this company culture that will be highly significant in Adobe executing its strategic objectives for both greenfield spaces like the metaverse, as well as for protecting its leadership in established markets.

A Review of History to Understand Adobe’s Culture

Company culture is arguably the most powerful determinant of future business success. It just so happens that, because many of the stocks we cover are younger, there isn’t always enough history to evaluate the cultural underpinnings. This is not the case with Adobe, because the company’s timeline stretches back 40 years and is rich with milestones that have had instrumental impact on the digitalization of the creative economy. Here we’ll review some of Adobe’s major innovations:

PostScript: In the early 1980s, together with Apple and Aldus, Adobe gave the world desktop printing. Apple’s Macintosh provided the slick GUI (graphical user interface), Aldus’ PageMaker provided the word/graphics manipulation, and Adobe’s PostScript was the language that allowed users to connect their PC to external printers and print stuff. This trifecta of software launched the desktop publishing revolution as it empowered PC users with flexibility and end-to-end control of the publishing process – content, editing, and printing.

PostScript was a super revolutionary program, as before users needed to buy a special device to connect a PC to a printer that was not compatible with any other printer and produced low-quality characters. With PostScript installed on the PC, users could connect their PC to any printer and print much higher-quality materials.

Illustrator: Adobe’s founders, John Warnock and Charles Geschke, didn’t bask in their successes with PostScript; they quickly innovated across adjacent areas within the publishing domain. In 1987, they released the vector-based graphic design application, Illustrator. Vector-based artwork is based on mathematical equations that allows a design to be scaled large or small and still be perfectly presented – the alternative is a raster image which is based on a fixed number of pixels and doesn’t scale in size well. Until the mid-1980s vector graphics were largely inaccessible because they were only available on mainframes. PageMaker (1985), Illustrator (1987), and CorelDraw (1989), were desktop applications that democratized vector-based graphics for anyone with a PC.

Figure 1 - Vector vs Raster Images

Source: pavilion.dinfos.edu

Illustrator wasn’t the first vector-based graphics application for the desktop, but it was the first to incorporate something called Bezier curves which enables users to draw smooth curved lines, which ultimately elevated it to become the best PC design tool on the market. 20+ new versions and 40 years later, Illustrator is still the undisputed king of vector-based graphic design thanks to the company’s Kaizen-like focus to keep improving the product. Over the years, Illustrator has expanded from being used for package labelling, magazines, and logos in the early days, to being used in pretty much any industry for anything from CAD engineering use cases to apparel design.

Photoshop: In 1988, brothers Thomas and John Knoll created Photoshop, which at the time was the first photo image editing application. Reportedly, a mere 200 copies of Photoshop were distributed with a scanner company called Barneyscan before Adobe got in touch with the Knoll brothers and offered them a licensing deal – and in 1995 Adobe claimed full ownership rights.

Similar to Illustrator’s evolution, since the inception of the licensing deal with the Knoll brothers, Adobe has continuously improved Photoshop. So much so, that today it has 36% of market share and the product has become so popular that it has long been used as a verb - just like ‘Google’, ‘FaceTime’, and ‘Uber’ have.

Premiere: Being convinced that Adobe needed to diversify to remain relevant in the fast-moving creative industry, Warnock pushed Adobe to add another product to the suite. The resulting next product, launched in 1991, was the video editing application, Premiere.

Previously, editing systems consisted of bespoke hardware and purpose-built software, so Premiere was a major breakthrough as a software-only video editor. It also pioneered affordable NLE (Non-Linear Editing) which makes life for post-production teams so much easier because they can edit any frame without needing to play adjacent footage, and overall, it provides substantial flexibility compared to the linear alternative.

Again, this was a revolutionary product, to the point that in the early days Premiere couldn’t reach its potential due to the compute limitations of desktop computers, so very low video resolutions were the norm. Today, Premiere (PRO) is still generally regarded as the leader in video editing for amateur and professionals and is one of very few applications that can handle 8k resolution videos.

Acrobat: By 1993, there were many different types of documents that could be created and edited with Adobe products. These documents were being sent to other people to view and edit that were using different computers and software. The major pain point was that a piece of artwork or document would often look different when viewed on different computers, or not be viewable at all if the recipient didn’t have the same editing software it was created on. Warnock’s and Geschke’s solution was Adobe Acrobat, consisting of the PDF (Portable Document Format) – convert the file to PDF and it will be presented exactly the same regardless of hardware, software, or OS. When we think about how Word documents can still appear differently across different devices, it highlights the innovation of the PDF.

For 15 years, PDF was a proprietary format controlled by Adobe. A deal with Netscape propelled Acrobat’s use on the web but PDF only started to gain widespread popularity in the early 2000s, following various updates to the software. Then, in 2008 it became an open standard, published by the International Organization for Standardization, at which time control of the specification passed to an ISO Committee of volunteer industry experts. In the current age of transferring, uploading, and downloading across the Internet and various systems, the PDF has exponentially grown in importance, but the story would have been different had they kept it proprietary.

Allowing PDF to become an open standard means Adobe can’t directly monetize it, but the high-quality products Adobe produces for desktop, mobile, and the web, enable users to do many things with PDFs. Given the deep-seated knowledge and experience of working with PDF, Adobe Acrobat remains the top application for creating PDF-related value for users, and further value as they incorporate PDF documents with other Adobe products in their workflow.

Intelligent M&A: Over the years Adobe has made some smart acquisitions. In 1994, Adobe acquired Aldus, which was an intelligent move because Adobe did not have an equivalent to PageMaker and Aldus had recently launched a high-quality, consumer-targeted photo editing application, and in general the two were becoming increasingly similar. The longer-term rewards of the acquisition, however, transpired to be Bruce Chizen – the Head of the Consumer Division at Aldus who, subsequent to the acquisition, was given the responsibility to grow Adobe’s own non-professional consumer market. Until that point, Adobe was targeting the creative professionals, though management understood that there was a lot of opportunity in the amateur consumer market. Chizen’s leadership as Head of Consumer Products and then as CEO in 2000, was integral in Adobe’s success in gaining appeal to the consumer market and building out a broader moat.

In 2005, Adobe acquired Macromedia for the acquiree’s Flash technology and its web development tool, Dreamweaver. During the 1990s/2000s, Flash was pretty much the only software available to create animation and video for the Internet, and Dreamweaver was proving to be very appealing to website and graphic designers and encroaching on Photoshop’s territory. Hence the Macromedia acquisition was a pivotal moment in Adobe’s history as it exposed Adobe to more of the consumer and web market whilst also removing competition. In fact, one could argue that this served as a key stepping stone for Adobe to better understand how their products can fit in with the pervasive use of the web and eventually in building out their Adobe Creative Cloud platform in 2013 – in other words, how they could transition from traditional licensed-based software to SaaS.

The last major acquisition we’ll mention is that of Omniture in 2009. Omniture was a web analytics company that helped online marketers assess the impact of digital experiences, and has proven to provide an abundance of synergy with Dreamweaver in combining web analytics with web design tools. At the time, CEO Shantanu Narayen was criticized for the acquisition, as analysts didn’t see the synergies with Adobe’s existing portfolio nor did they understand Narayen’s vision.

Narayen foresaw the deep connection between content creation and analytics long before the rest of the market. With hindsight, of course, if content is going to be a competitive advantage for a company, then customers need end-user analytics to provide a rich feedback loop in order to optimize. This wasn’t so obvious back in 2009, however. In essence, rich end-user insights >>> leads to better content >>> which leads to more business >>> which leads to more content production >>> which leads to more usage of Adobe’s platform. Truly an incredible vision by Narayen that, as we touch on in the next section, has played out extremely well for Adobe.

Move to Cloud: 2007 was a major turning point for Adobe - Narayen was appointed CEO and he had a very long-term and ambitious vision for the company. If we were to categorize the different eras, then the Warnock/Geschke tenure (1982 to 2000) is characterized as the home-grown innovation era; the Chizen tenure (1994 to 2007) is the M&A, product expansion, non-professional, and moat broadening era; and the Narayen (2007 to present) is defined as the cloud transformation era.

As early as 2007, some of Adobe’s smaller competitors were delivering their software in SaaS form, and Narayen could see that in the long-term the benefits of SaaS (frictionless user onboarding, zero-touch and frequent software updates, the recurring revenue model, etc.) were going to gradually push license-based software to the fringes of the market. Furthermore, he could see that Adobe’s higher lock-in, license-based model would be considered less attractive against SaaS alternatives in vying for new customers.

Shareholders saw it differently, however. They believed it was a huge risk because they were unsure whether the software could be delivered from the cloud without interruptions and it also raised issues pertaining to users wanting to work whilst on the road. In weighing up the risks and benefits of SaaS, and noting that the SaaS-delivered software market had already reached $5bn and growing at c. 100%, Narayen set out to put the wheels in motion.

In 2008, Adobe released Photoshop Express, the web version of Photoshop; in 2009, as aforementioned, the acquired Omniture for web analytics with the objective to turn Adobe into the ‘big data’ platform for online marketing; and in 2010, they launched a SaaS eSignature solution.

Figure 2 - Photoshop Express - the Web Version of Photoshop

Then in 2013, Adobe went all-in and launched Creative Cloud, which consisted of their entire Creative Suite, and then some, converted into SaaS form. It was also announced that all future software versions would only be in SaaS. This radical vendor transformation to the cloud, whereby Adobe completely shifted to SaaS and pretty much discontinued servicing the perpetual licensed packages, was an extremely high risk move but with hindsight has become a textbook example of a SaaS implementation. At the time, almost all other legacy firms transitioning to the cloud decided to still offer and service their licensed-based software.

As Adobe developed and expanded its Creative Cloud, it evolved into a comprehensive digital marketing and digital media platform. With such broad and integrated capabilities, Adobe began to accompany its bottom-up sales approach with a top-down one, targeting the C-Suite executives and landing larger deals. Within a couple of years of the Creative Cloud release, over 65% of revenue was from subscriptions, and this percentage increased to 90%+ in 2020.

Figure 3 - Adobe Subscription Revenue by Quarter

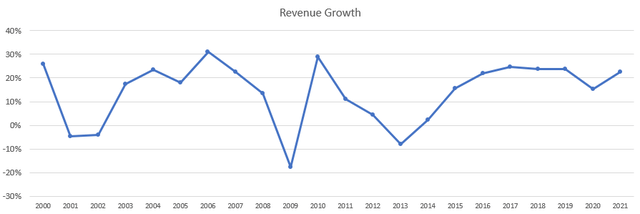

Historically, Adobe’s annual growth was very volatile, though since Creative Cloud it has stabilized and also accelerated. Now that 96% of revenue is subscription-based, going forward we expect growth to continue being less volatile.

Figure 4 - Revenue Growth Since 2000

Source: Company data, Convequity

More recently, Adobe introduced two other cloud platforms, the Document Cloud and the Experience Cloud – both of which are growing fast and we’ll discuss these in the next section.

To summarize, Adobe’s transition to the cloud has been impeccable and has been firmly reflected in the financials. In large part, the success can be attributed to;

Making tough decisions early on and shifting their entire focus to delivering their best-in-class software from the cloud.

Adding a richer set of features to the SaaS-based software.

Broadening into an all-encompassing digital media and marketing cloud platform.

Expanding beyond creatives to target C-Level executives in the quest to win more large enterprise deals.

Culture, Culture, Culture

So, after this lengthy (but we insist necessary) review of Adobe’s historical innovations, what does it tell investors about the company’s culture? Our take is that the culture has been nurtured by the leadership, in that over the years, they have been less concerned with expanding the company’s TAM and more concerned with retaining its best-in-class status within its area of expertise in the creative industry. This focus from the top down, has instilled an obsession throughout the company to remain the number one in the industry.

We sense that there is almost a cultural fear of the company losing its industry status which spurs on this Kaizen-esque determination to continually improve its products. We also speculate that the slow-ish growth and expansion in the first half of the Adobe’s history allowed this company culture to develop. And in more recent times, having this strong and well-defined culture firmly embedded has laid the foundation for a more prolific M&A strategy to be successful.

We suspect this culture infused throughout Adobe – vertically and horizontally - will serve as a ubiquitous sounding board for C-Level executives when contemplating future acquisitions, to ensure any M&A does not deviate the strategy and resources away from what Adobe loves to do best – which is helping customers be creative, and effective in driving positive business outcomes with those creations.

The Current Cloud Strategy

In essence, Adobe’s strategy is its cloud strategy; and going forward this will be spearheaded by Creative Cloud, Document Cloud, and Experience Cloud. Each cloud platform is packed with endless features and collectively they enable teams to produce creative content (Creative Cloud), work with documents in a frictionless manner (Document Cloud), and gather data about their customers and target them with personalized marketing (Experience Cloud).

Figure 5 - Adobe's Three-Pronged Cloud Strategy

Source: Adobe

Creative Cloud

Adobe’s heritage is in the Creative Cloud, hosting various industry standard applications such as Photoshop, Illustrator, InDesign, and Premiere Pro, as shown in the table below. Generally, whatever nifty visual you notice that grabs your attention was either created using apps from Adobe’s Creative Cloud or could have been created using apps from Adobe’s Creative Cloud.

Figure 6 - Creative Cloud Applications

Source: Convequity research

It’s quite remarkable how Adobe, in the face of perennial competition from nimble and innovative startups, has managed to retain its technical and market leadership across such a variety of areas within the creative domain.

We also like the potential in Adobe’s recently released Creative Cloud Express, which is a web and mobile app that enables creators to quickly produce visuals/content from thousands of fonts and millions of images, and it is conveniently integrated into all the social media channels. Adobe was quite late in serving this market need but thanks to Adobe Stock – one of the largest image libraries in the world – and Adobe’s decades of innovation, Express seems destined to be really successful. With no learning curve, Express will appeal to the social media influencer market and other non-professional creatives.

Document Cloud

Document Cloud provides a suite of solutions for document creation, sharing, editing, eSignature approvals, reader analytics, and more. It has been built atop the innovations of Acrobat and the PDF standard and also incorporates various work management (collaboration, communication, coordination) tools for streamlining workflow processes. As we outlined in the recent MNDY report, productivity will continue to be an area of innovation, and we see Adobe as having an advantage thanks to the synergistic value derived when there is cross functionality between the Document Cloud and the Creative Cloud.

The digital signature market size estimates range from $10bn to $20bn and is projected to grow at around 30% for the next few years. As outlined in the ASAN and MNDY reports, the range of work management market size estimates are from $10bn to $30bn with 20%-30% annual growth projections. On top of that, there is the collaboration TAM for Adobe to go after. Needless to say, that this is a huge market to target.

Given Adobe’s invention and experience with the PDF standard and its development of Acrobat, the Document Cloud was a very organic move and extremely value-enhancing for users and teams using other parts of Adobe. It could also be considered a much-welcomed platform extension for creative professionals that, once they have created a first draft piece of content and/or visual, need a streamlined way to share, receive feedback, allow collaboration, submit a final draft, and then seek approval, all across various areas of their organization.

Thus far, Adobe’s execution here has been very good. For FY21, Document Cloud ARR (Annual Recurring Revenue) grew 31% to reach $1.9bn. Adobe has 2.5 billion mobile and desktop devices with Acrobat installed and active users for Acrobat Web has grown 100% from last year.

Experience Cloud

The Experience Cloud is the largest departure from Adobe’s origins, though it is certainly very synergistic with the rest of the cloud platforms. Since acquiring Omniture in 2009, Adobe has continually added more capability to their web marketing analytics offerings.

Figure 7 - Scope of Adobe Experience Cloud

Source: Adobe

There is an abundance of tools for marketers to utilize within the Experience Cloud. The high-level takeaway is that the platform empowers enterprises to send personalized marketing material and offers to customers at opportune times.

One hypothetical example I saw was a marketing professional needing to fill 25 rooms on a cruise ship that were suddenly cancelled for a wedding. She needed to urgently create marketing material including a discount offer, disseminate it globally but also in a targeted and personalized manner, make sure the material was perfectly compatible with all device formats, and also make it compatible with previously published marketing material. And she managed to swiftly do this all in a day’s work (could have been exaggerated but seemed plausible given the software capabilities).

Another hypothetical example: a marketer at a fitness chain noticed a member hadn’t attended to some classes recently, and hence she decided to reach out to her with new offers, alternative classes, and virtual classes, in the quest to reengage with her.

So, as these examples attempt to articulate, Adobe’s Experience Cloud is offering marketing professionals the capability to conduct personalized marketing campaigns at scale. Additionally, its very much about giving marketers the ability to understand the current status of the customer journey (prospect, new, loyal, former) and target the personalization accordingly. Furthermore, Experience Cloud gives enterprises the big picture analytics so they can develop effective marketing campaigns and deliver enriching experiences for customers.

Figure 8 - Understanding the Status of the Customer Journey

Source: Adobe

Adobe also extends the customer experience endeavours to physical POS (Point of Sale) instances, whereby the barista, retail assistant, or customer rep, can receive timely customer information in order to make a tailored offer at the point of sale. And what is impressive is that Adobe integrates its applications from one cloud to applications in another cloud, like Adobe Sign, for example. The following screenshot is from an Experience Cloud presentation, showing an example of a barista being informed that Lizzie has previously expressed interest in buying a coffee machine, and Lizzie goes ahead to make the purchase and uses her Adobe Sign to sign for the warranty agreement.

Figure 9 - Experience Cloud Seamlessly Integrating Adobe Sign for Commerce Use Cases

Source: Adobe

Sensei

Sensei is an AI tool integrated with the Experience Cloud, helping expedite processes from marketing ideation through to execution – and it is highly recommended from various sources online. It also integrates with apps in the Creative Cloud and the Document Cloud portfolios. It has been developed to automate the creation and delivery of personalized content allowing marketers to develop their content strategies based on accurate intelligence and provide a significant boost to online sales.

Again, we view this as very in keeping with Adobe’s objectives of enhancing the user experience right from creative brainstorming, to content creation, collaboration, and the final execution.

Some Thoughts on Adobe’s Moat

Like any other major tech player, Adobe has cultivated an impressive moat. However, whereas other big tech companies have established their moat via powerful network effects, Adobe has done so with steep learning curves that are required for maximizing the power of their best-in-class software. To become proficient with Adobe necessitates a lot of time and effort and hence its products are very sticky. And in the past 10 years, Adobe has strengthened their moat via network effects inside of enterprises that use its cloud platforms.

The sheer breadth of products also solidifies Adobe’s moat via pricing power. For example, a user may consider getting Photoshop, Illustrator, and InDesign, for a total of $66.12 per month, however, they would be better off buying the entire Creative Cloud for $55.64 per month. Furthermore, Affinity Designer is a competitor to Illustrator that costs $54.99 per month, which highlights Adobe’s pricing power – it will be very difficult for smaller players to gain market share from Adobe. And once Adobe has customer lock-in, they have the opportunity to gradually raise prices each year to supplement growth.

Figure 10 - Adobe's Pricing Power

Source: Adobe

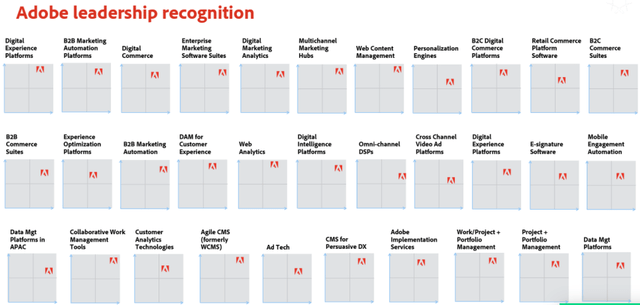

So, Adobe has established an almost impenetrable moat as a result of the steep learning curve of its products, the pricing power derived from the sheer breadth of its platforms, but also simply because of their excellence across a wide variety of markets. Below we show Adobe’s positioning in Gartner Magic Quadrants for 33 markets – they are categorized as a Leader in each one of them.

Source: Adobe

Future Growth

In simple terms, we see Adobe’s growth coming from two avenues:

From existing customers that are exploring and capitalizing on digitalization themes – personalization, customer journey marketing, interactivity, the creator economy, and the metaverse.

From TAM expansion as they move into adjacent markets connected to CX and data analytics.

In regards to the metaverse in particular, Adobe believes it will play an integral role in the creation of virtual goods and artifacts. It has two industry-leading products – Substance 3D and Aero – that allow users to create high-quality 3D designs and AR (Augmented Reality) productions, respectively.

Figure 11 – Adobe Substance 3D

Source: Substance 3D Painter First Steps: 01 - Creating a Project, Materials & Masking

Figure 12 - An Adobe Aero Tutorial

Source: Creating an Interactive AR scene in Adobe Aero

Adobe is already heavily used in the gaming industry – applications like Illustrator and XD are often used by game developers. Substance 3D, of course, adds the 3D component, and has been extensively used in many games such as Fortnite, Assassin's Creed Odyssey, and Shadow of the Tomb Raider. Due to this foothold with game developers, we think it’s rational to expect Adobe will be a beneficiary of metaverse developments within the gaming industry.

But, of course, gaming is only going to be one component of the metaverse. Creatives from all backgrounds are going to dabble in the metaverse and even use it as their primary target market, so Adobe has a lot of growth ahead. And reassuringly, Adobe is not resting on its laurels with Substance 3D and Aero, they are already working on other 3D and immersive projects.

Figure 13 - Adobe is Pushing the Frontiers of 3D & Immersive Creation Ready for the Metaverse

Source: Adobe's Metaverse White Paper

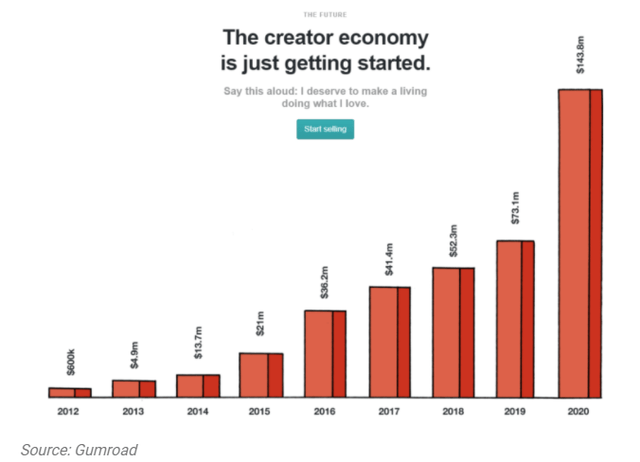

Adobe is also going to be a beneficiary of the growth in the creator economy. Many Gen Z youngsters are aspiring to be content creators in replace of lawyers, doctors, and bankers. Then, as is now well reported on, the pandemic pushed many people into turning their passions and interests into fully-fledged businesses by leveraging the power of social media platforms.

There are over 50 million independent content creators, making the creator economy worth c. $20bn in 2021, and it’s expected to grow to $100bn this year. Adobe’s Creative Cloud Express is a timely new product that we anticipate is going to have tremendous success in serving the needs of these micro entrepreneurs.

Figure 14 - The Creator Economy

Source: https://www.antler.co/blog/the-ultimate-guide-to-the-creator-economy

It’s also worth mentioning, that Adobe has about 600 million people using its platforms and only c. 30 million are paid users. And they have an AI-infused data-driven operating model that intelligently attempts to up and cross sell products to its freemium and paid users.

Leadership

Before we conclude Part 1, we want to briefly share our thoughts on Adobe’s leadership team. Firstly, since taking charge in 2007, Narayen delivered one of the best cloud transformations in the history books. Ultimately, this not only ensured Adobe’s industry status but also accelerated and stabilized growth and helped lift the company’s profit margins. Narayen has clearly demonstrated that he has a great ability to envisage the future, particularly showcased with the 2009 Omniture acquisition. And we expect his visions with respect to Adobe’s roles in the creator economy and the metaverse will also transpire to be accurate. As potential future investors, we also appreciate how he has led the slick M&A strategy whilst also maintaining Adobe’s strong, innovative, and obsessive culture.

Though, Narayen has also formed a solid leadership team around him that are in charge of leading Adobe’s respective cloud strategies. We went through the 4Q21 earnings call transcript and its clear that each member of the executive team is highly enthusiastic and passionate about the future – in fact, the transcript is a very long read that took me two visits to get through. This is not in contrast to all other management teams, but personally I’ve noticed when it doesn’t seem like management are particularly energetic for the earnings call. This certainly wasn’t the case in Adobe’s 4Q21 call, whereby each CXO was super enthusiastic to share all the details of product development and their visions for the future.

Conclusion

Adobe has an illustrious timeline of industry-defining innovations.

Just as impressive is the way in which Adobe has managed to retain its industry-standard status for various products of its suite, despite numerous startups to compete against over the decades.

We infer that the slow-ish growth in the early days, enabled Adobe to instill a culture hyper-focused on retaining its status as the standard setter across various areas of publishing.

Adobe has had great leaders in charge of the company. Narayen, in particular, has done a tremendous job at transitioning Adobe to wholly focused SaaS vendor.

Adobe’s cloud strategy is smart and easy for investors to comprehend. The Creative, Document, and Experience Cloud platforms are each performing well and together generate substantial synergy for users and their enterprises.

Adobe can provide users, teams, and enterprises with an end-to-end solution for content creation, work management and productivity, and CX management. And we would say there are ample opportunities for Adobe to expand its TAM in the adjacent data & analytics markets.

The booming creator economy and the huge greenfield space of the metaverse present Adobe with a long runway of growth. Very reasonable to expect double-digit annual growth for several years ahead.

"It’s also worth mentioning, that Adobe has about 600 million people using its platforms and only c. 30 million are paid users". Interesting data point, where is this data from? Thanks