AVGO + VMW - Value In The Rough - Part 4

Summary

In Part 4 we cover Broadcom's future and competitive standing.

We discuss Hock Tan's rare leadership and why Broadcom is the preferred vendor to work with for many hardware makers.

We also discuss Broadcom's strengthening position within the emerging DSA and infrastructure software landscapes.

Lastly, we do an in-depth valuation of Broadcom, pre and post VMware deal.

AVGO Future & Competition

As we've outlined earlier, AVGO has a successful track record of finding valuable acquisition targets and growing shareholder value. This is supercharged by a favourable capital structure akin to BRK or PEs with permanent capital.

To conduct the valuation analysis we need to have a good sense of the future expectations for AVGO. The most important factor is probably the leadership and talent as they will continue to define AVGO's M&A and product expansion strategy.

Rare Leadership

AVGO is a company with so many financially-driven acquisitions and many characteristics reminiscent of legacy tech. It is very easy for an analyst to apply the traditional legacy tech bias against AVGO. However, we believe Hock Tan, the mastermind behind AVGO, is probably among the rarest managers that may eventually be considered a legend of the fabless industry, alongside Jensen Huang of NVDA, and Pat Gelsinger of INTC. Hock Tan is not the typical founder with huge equity ownership, but he has been instrumental in AVGO's success right from the start when the company was created in 2006.

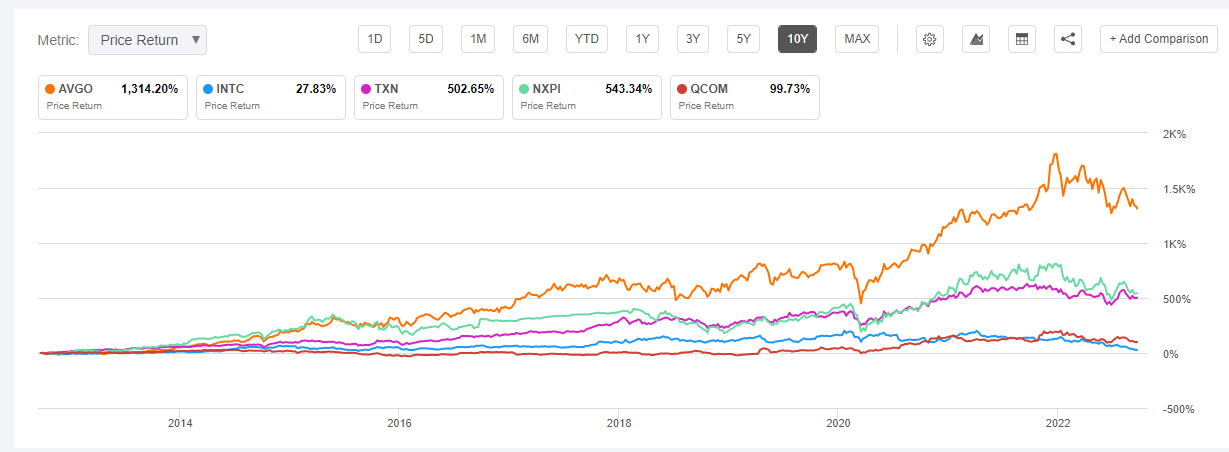

Hock Tan's leadership at AVGO is nothing sort of epic. AVGO has delivered ~14x return to shareholders in the past decade despite the recent selloff. Among the top 6 fabless vendors, this is only behind NVDA's stellar ~39x return. In comparison, INTC (~1.4x), TXN (6x), NXPI (6.4x), and QCOM (2x) are all in scales of magnitude behind AVGO and NVDA. Not surprisingly NVDA is the only one with total founder control while AVGO has semi-founder control.

NVDA's success emerged from Jensen Huang's decade-long bet on CUDA (Compute Unified Device Architecture), accelerating compute, and ML/AI. AVGO's success is predicated on more of a blend of technology and business as Hock Tan has a unique mix of engineering and business background. From 2009 to 2020, AVGO delivered 16x in revenue, 25x in R&D budget, and 84x in operating profit. The biggest driver of these results is its strong focus on being the category leader in each field it acquired.

Unlike CSCO, and many other legacy tech giants controlled by professional managers, AVGO is able to expand the category leadership from 8 to 23. This allows AVGO to compound and create value out of every business that it acquired. Even better than this is the end shareholder return that is not diluted by the M&A (except for the AVGO and Broadcom merger that resulted in a ramp up in share count). Hock Tan is able to leverage the existing cash flow machines to buy more great businesses at low prices, and grow them efficiently.

Hock Tan of AVGO, Jensen Huang of NVDA, and Pat Gelsinger of INTC - these three executives share similar traits:

Bold technical vision in technology roadmaps that few believed in the beginning, but transpired to be the future.

Sharp business acumen on the future of the industry, the ecosystem, and business profitability.

Perseverance in execution to ensure long-term visions come to fruition.

But it appears that these three executives are once again being challenged. NVDA is facing another cyclical headwind. AVGO continues to be misunderstood by investors in general. And INTC is facing a dark moment as investors begin to doubt Pat Gelsinger's ability to turnaround INTC. However, excellent leadership eventually prevails over the long-term, so investors should have some more patience yet.

Business Outlook

At a high level, there are a few factors we that make us bullish on AVGO:

The management is savvy with right sense of ownership, and possess an aggressiveness unseen from legacy tech giant managers.

The semiconductor industry's overarching theme is consolidation, and AVGO has been leading here for many years.

Execution is very strong and the track record is underappreciated.

These will continue to be the long-term fundamental drivers of AVGO's success.

On specific product lines, let's go through individual items.