Full Report - JAMF - Great Alpha From Market Misunderstanding (1/3)

Market believes that AAPL will kill JAMF, while we believe the opposite is true.

Welcome to Convequity's Quick Takes— Timely interpretation of news & special events for cybersecurity and enterprise tech investors. If you are new, you can join our email list here:

This is the edited version originally from the discussion within Convequity on 22nd May 2021,

Sources of Alpha: Complexity of the Business

Expected Price Appreciation: 123% from $30 within 2 years

Executive Summary

Given employee PC choice trends, Apple’s push into business, and COVID-driven digitalization acceleration in education and healthcare, JAMF are in a prime position for the next 1 to 3 years.

The recent Wandera acquisition offers ample synergies for strong revenue performance.

~50% mispricing is attributable to investors assuming Apple’s acquisition of Fleetsmith is an existential threat to JAMF – we outline the very low probability that this is the case.

Contents

Article 1

Overview

Why Do Organizations Need and MDM?

Why JAMF?

Growth in Mac Demand

Growth in iPad Demand

Article 2

Competition

Is Apple a Threat?

Wandera Acquisition

Article 3

Revenue Sources Recap

Quantitative Revenue & Valuation Analysis

Conclusion

Overview

History/evolution: Founded in 2002, JAMF develops software for IT administrators to configure and automate tasks for fleets of Apple devices with organizations. It began focusing on Mac PCs and over time has added the iPhone, iPad, Apple TV, and even Apple Watch to its suite of Mobile Device Management (MDM) capabilities. The company has now accumulated over 10 years of experience managing the entire portfolio of Apple products within the business environment. However, they also have a deep integration with helping with Windows issues and tasks. In 2017, software expert PE firm, Vista Equity Partners, acquired a majority stake in JAMF and has been successful in leveraging JAMF’s core competencies pertaining to Apple management expertise, to grow revenues and turn the company profitable.

Markets served: JAMF are primarily known for serving the Apple MDM needs of the enterprise segment, though they also serve the SMB market. They also have a strong presence in public sector verticals such as education and healthcare.

Products:

In essence, JAMF Now is for the SMB market that typically have simpler deployment and smaller fleets of devices. JAMF Pro is for enterprises with complex requirements. JAMF School, is obviously for schools and universities and also contains subproducts such as JAMF Teacher and JAMF Parent. JAMF Connect is an identity security application that integrates with other IAM vendors such as Okta. And JAMF Protect delivers endpoint protection for devices against the likes of malware.

Sales distribution: JAMF have a robust multichannel sales distribution that includes a JAMF sales force, Managed Service Providers, value-added resellers, System Integrators, public cloud marketplaces, and mobile carriers.

Competitors: Key competitors are Workspace ONE (owned by VMware), Citrix, and MobileIron (owned by Ivanti). JAMF’s large-scale rivals offer Apple and Android MDM services.

Interesting facts: Apple uses JAMF software to manage their own fleet of products across their organization. Fellow MDM competitor IBM, actually uses JAMF instead of their own capability to manage Apple devices.

Market cap & share price: $3.6bn and $30/share.

Intrinsic value range: $50 to $70.

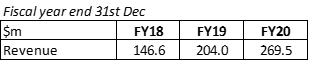

Revenue:

Why Do Organizations Need an MDM?

The idea is simple - use software to standardize and automate the MDM jobs typically handled by the IT desk within enterprises.

Before JAMF and MDMs in general, intensive labor work was required for a company to manage its fleet of devices (computers, tablets, phones etc.) used by employees. Tasks like configuring the device, installing software, updating them, and fixing bugs are repetitive and time-consuming. Personal issues related to using the hardware/software are even more expensive to solve as a typical employee may raise two or more tickets per year and that generally costs an IT expert 2-3 hours to solve - about $100 per year.

With JAMF, the orchestration and maintenance work are extraordinarily seamless, simple, and efficient. Almost all work related to managing the device can be done remotely and at scale - within a few clicks one software can be installed and configured into thousands of devices (e.g., instantaneously adding three WiFi credentials to 1000 devices). At the moment, JAMF charges c. $14 per device, which is a big bargain considering the value delivered.

Organizations having a mix of employees using corporate-owned devices (COPE) and their own personal devices (BYOD) is complicating the MDM landscape and making it even more of a necessity for IT admin teams to use specialist software. COPE devices have already been configured to protect corporate data and hence give IT higher levels of visibility and security. However, protecting corporate data in BYOD situations, whereby employees are mixing personal use and work on the same device, poses many risks. There is also the consideration of what to allow employees to do on COPE devices during their leisure time – if at all.

To add even more complexity, employees are using a mix of apps located in the cloud and located in the corporation’s private data centre. Productivity and user experience is also paramount, therefore, having employees’ connection to cloud-based apps routed via VPN through to the security checkpoint at HQ/data centre is no longer viable. Employees want the most direct access to cloud-based apps. With all this intricacy in mind, the focal point of security, productivity, and management, needs to be the user and the device – not the network. This is why zero trust and Identity Access Management (IAM) have become so important in recent years, especially since COVID-19, as they are predicated on protecting the user, device, and data, wherever they may be located. And an MDM solution greatly enhances these security protocols and improves employee and IT productivity many times over.

An MDM solution enables IT operations to automate a bunch of repetitive tasks and become way more scalable. MDMs empower IT to efficiently deploy devices, preconfigure device settings, remotely update software, automate tasks, and give IT the inventory management tools to track and maintain the latest information on the organization’s fleet of COPE and BYOD devices. Moreover, MDMs seamlessly integrate with cloud identity providers for enhanced security and user experience.

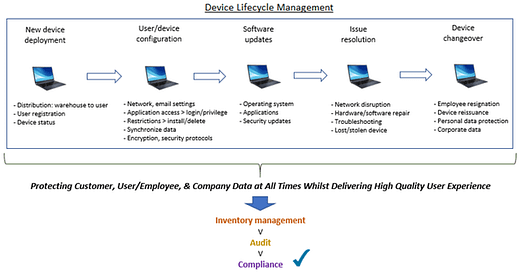

Below is a diagram depicting the types of work IT need to do throughout a device’s lifecycle – from deploying a new device to an employee to reissuing a device upon an employee leaving the organization. Ultimately, effective device lifecycle management contributes to the continual protection of customer, user, and company data. It also leads to accurate hardware and software inventory management, which in turn results in successful audits and adherence to compliance regulations such as the Sarbanes-Oxley Act and the GDPR. Without an MDM, IT teams would have to take receipt of each individual device, manually configure settings and add the apps, manage software updates with insufficient computing resources, troubleshoot with incomplete information, and manually manage inventory on an Excel spreadsheet.

Figure 1 - Device Lifecycle Management

Source: Convequity

Why JAMF?

Whilst other MDM vendors have aimed to serve markets for Apple and Android devices, since its founding in 2002, Jamf Holding Corp. (JAMF) has focused exclusively on Apple devices. This narrower scope has nurtured a more nuanced understanding of what organizations require to maximize the productivity from their fleet of Apple devices.

Apple has an isolated closed-ended ecosystem much less compatible and open compared to open-source systems like Linux and widely used ones like Windows. This philosophy ensured Apple's greater overall software/hardware user experience but also made its applications and configurations vastly different from others. As a result, a specialized, for-Apple solution/application is often needed. This is especially the case for MDM as the specifications on Apple devices are very different architecturally. As the sector-defining vendor, JAMF benefited tremendously from the network effect as the first-mover vendor with the largest user base, a highly active community called JAMF nation, and the most polished products.

Much like Microsoft, Apple has native tools for managing devices but it comes as barebones - limited functionality unusable for enterprise cases and this allows vendors like JAMF to leverage APIs and configuration profiles to solve customers' emerging demand. Due to JAMF's longstanding status, it is the BoB and the standard setter in this space. There are also minor players in this space mainly competing based on price but the products are still highly underdeveloped - these players include: Mosyle, Fleetsmith, IBM, Kandji, Addigy. Overall, JAMF’s competitive positioning looks similar to Okta’s in the identity management space – yet JAMF’s price multiples are a fraction of Okta’s.

According to our research, we’ve found that this enduring and undivided commitment to Apple has resulted in JAMF delivering the industry’s:

broadest product and feature offering

most sophisticated customization options

most detailed training guides and product documentation material for IT administrators

most capable technical support

most overall capable MDM solution

Additionally, JAMF is the only MDM vendor capable of providing same-day support for macOS, iOS, and iPadOS software updates. There are still numerous vendors that don’t support Apple’s M1 chip and Big Sur macOS that were released in November 2020. JAMF integrated these significant system upgrades on the first day they were available.

As the leader in Apple MDM for nearly two decades, JAMF has cultivated an impressive IT user community called JAMF Nation, which has over 100k members. JAMF users share their problems to the forum and promptly receive ideas to try from the user community. JAMF Nation combined with the training guides, product documentation, and highly capable technical support, are key components that deliver a very high level of user satisfaction according to our research. Later in the report we’ll delve deeper into JAMF’s attributes versus key competition.

The Growth in Mac Demand

PC of Choice

According to IDC, in 2019 Macs represented 17% of the enterprise PC market and today the penetration has increased to 23%. That’s an incredible 6 percentage point market share move in just two years. Much of this increase is attributed to organizations offering their employees a PC of choice during the WFH conditions of the pandemic. Because of the popularity of Apple devices, it makes sense that many employees, with and without a personally-owned Mac, would choose a Mac for work purposes. Those who personally own a Mac would likely choose a Mac for work based on familiarity, and those who don’t personally own a Mac, perhaps due to affordability, would likely take advantage of an employer-expensed Mac to use for work.

Increasing Mac penetration is likely to continue as corporations strive to keep up with peers and keep their employees happy. IDC’s 1Q21 PC data shows that Mac shipments grew 112% compared to the same period a year ago. Note that the shipment data below includes all PCs – for consumers and business. This growth is Mac usage is a significant tailwind for JAMF’s business. JAMF’s 1Q21 YoY revenue growth was 34%, showing an uplift to prior quarters. Due to its longstanding commitment, JAMF are the preeminent MDM vendor when it comes to Mac management, so investors should expect the upsurge in Mac demand to flow down to continued strong revenue growth for JAMF. And thus far, these market developments have not been reflected in the share price, thereby presenting additional upside opportunity for investors. Later in the report we’ll cover why we believe there is such a significant mispricing on JAMF’s stock.

Figure 2 - 112% YoY Growth in Global Mac Shipments

Source: idc.com

M1 Chip

Given the timing of the M1 chip release (November 2020), we infer that only a miniscule percentage of Macs shipped in 1Q21 would include the greater power and efficiency generated by Apple-designed silicon. So, as we go through 2021 and into 2022, Macs have another sales driver to support the increasing enterprise penetration.

The M1 chip gives Macs unparalleled processing speed and power consumption efficiency and many technologists believe it’s a significant milestone in computing. Apple has achieved this with an enduring focus on silicon development in a System-on-Chip, or SoC, form rather than the form of a traditional motherboard layout. Apple’s SoC has been present in the iPad, iPhone, and Macs, for the past decade, however, they’ve taken computing power considerably further with the creation of the M1 chip.

Figure 3 - Some Major Components of a Traditional Motherboard

Source: turbofuture.com, Convequity modification

As can been seen in the image above, the various components are spread across a traditional motherboard – on a SoC, they are located on one chip. In a typical motherboard like the one shown above, the distance between the Central Processing Unit (CPU) and the Graphical Processing Unit (GPU) – which is located in the PCI - creates an unwanted overhead as they pass data back and forth between their memory to complete processes. This is because until recent years, the CPU and GPU, along with other components, were too big to reside in one location. However, thanks to developments in silicon substrate technology, these components can now fit on one chip – hence the System-on-Chip name. Because of this miniaturization the CPU and GPU can utilize unified memory as a result of both the CPU’s and GPU’s memory being located on the same chip. This means that if data being processed by the CPU needs to be manipulated by the GPU, it doesn’t need to travel and can access a larger pool of memory. This tight integration reduces latency, increases computing power, and offers far more versatility as to what applications can do.

Apple are not the only company involved in SoC development – there are many others. However, they are certainly the leader due to a number of reasons, including:

Apple has the longest-standing experience in designing, manufacturing, and operating SoCs. It began c. 2010, about 2-3 years before Intel.

Apple’s hardware + software integration gives it a significant edge over other chip makers like Intel, Qualcomm, Broadcom, and Micron.

Given iPhone, iPad, and Mac shipments, Apple manufactures c. 100 million SoC chips per year – the most in the world for one chip.

Thanks to its successes, Apple attracts and retains the best available talent resulting in pioneering chip design.

More succinctly, we view Apple’s strength in SoC as founded on the following four competitive factors.

Figure 4 - Apple's Competitive Advantages in SoC Design, Development, and Manufacturing

Source: Convequity

Taking this into account, the M1 milestone could be another factor driving greater Mac adoption among enterprises (and consumers) as we move through the 2020s.

We’ve already pointed out the recent momentum in Mac demand, though taking a look at the following chart highlights the longer-term trend. The macOS, aka OS X, had been gradually gaining market share up until the 2015 to 2019 period in which it stalled and oscillated around 16% to 21%. Beginning in 2019, demand accelerated and continued into 2020/21 as a consequence of the WFH conditions. Given the recent trajectories and the notion that people are wanting or finding more use cases for more powerful desktop PCs, laptops, and notebooks, it’s plausible that the OS X market share can climb to within 20% of Windows’ market share within the next 10 years.

Figure 5 - Desktop OS Market Share in U.S.

Source: gs.statcounter.com

What it Means for JAMF

The recent surge in Mac is a result of COVID-induced market dynamics and this is expected to extrapolate throughout 2021 and into 2022. The introduction of the M1 chip is an added boost for Mac sales and a longer tailwind for Mac enterprise penetration. Given a substantial portion of JAMF’s revenue is generated from Mac MDM demand, these two factors are significant tailwinds for JAMF in the intermediate and longer term. And as aforementioned, this hasn’t yet been reflected in the share price because of investor worries over Apple’s own MDM intentions – more on this later.

The Growth in iPad Demand

Education

The pandemic also ushered in extra demand for iPads in sectors such as education. Since the 2014 peak, the tablet market has been in decline as a result of increasing durability and larger smartphones; however, in 2020 there was a reacceleration of growth to 13.5%. The reemergence of growth was driven by remote learning and government funding such as the March 2020 U.S. CARES Act that allocated $31bn to education (the Education Stabilization Fund). Similar government funded programs in Japan (GIGA School Project) and across Europe to support remote learning also boosted tablet sales. As Apple is the tablet market leader with 30%+ market share this surge in demand benefitted iPad revenue. As schools and universities acquired fleets of iPads and required a simple Apple specific MDM solution, JAMF experienced a jump in business within this vertical.

Figure 6 - Worldwide Tablet Sales

Source: uk.pcmag.com

In December 2020, the CRRSA Act was signed into U.S. law and provided the ESF with another $82bn. Subsequently in March 2021, the American Rescue Act granted an additional $170bn in new resources to the Department of Education, in which some more will likely trickle down into the ESF. Similar extensions to education funding are occurring throughout Europe also. All this funding for education will underscore further iPad demand and ultimately more demand for JAMF’s services.

JAMF was formulating a strategy to specifically target education long before COVID arrived. In February 2019, they acquired ZuluDesk, a provider of Apple-focused education technology, to broaden their education capabilities. In 2020, this was rebranded as JAMF School and there are subproducts such as JAMF Teacher and JAMF Parent. Beyond the standard MDM features such as device status management and issue notifications etc., JAMF School has specialist tools that allow teachers and IT to give students automatic access to subject materials whilst hiding unrelated content, as well as content caching to ensure a class circumvents slow internet connections and receives course materials in a timely manner. These type of nuanced use cases extend JAMF’s leadership in leveraging Apple in the education sector and puts them on a very strong footing to continue prospering amid the projected favourable market dynamics for iPads and MDM support.

Healthcare

Healthcare is another highly targeted vertical in which JAMF has launched specific products to help patients remotely connect to family, friends, and doctors. In 4Q20, JAMF received a U.S. patent for their Virtual Visits application that facilitates patients to seamlessly connect with family and friends using the likes of Zoom and Microsoft Teams without needing to login and without IT assistance.

JAMF has another two patent-pending apps that are being heavily used in the healthcare industries – JAMF Setup and JAMF Reset. These two apps enable iPad and iPhone sharing within organizations – whether it’s customers/patients sharing or employees. This is becoming popular in industries such as retail, hospitality, airlines, education, healthcare, and others. There are many cases whereby a user has finished with a shared device and it needs to be wiped and made ready for the next user according to individual requirements. This is not necessary with JAMF Setup and JAMF Reset. JAMF software integrates with Apple management systems to instantly enable app and settings personalization for each user that signs into that device. For example, a student can sign into to any iPad at school and have a personalized configuration displaying just the apps that they need. Moreover, IT can set up different personalization settings for different classes for each student. Similarly, JAMF software permits IT to configure settings so that employees can sign into shared iPads and have apps and the layout customized for specific roles. An employee may have multiple iPad settings for their various roles or functions at their place of work. Such intricate requirements cannot be delivered by other MDM vendors in the present time.

In November 2020, Virtual Visits supported by JAMF Setup and Reset, was rolled out to 11,000 iPads across 9,000 care homes for the NHS in England. IT Project Manager of Oxford Health at the NHS, Holly Panting, tells her account of how JAMF removed the obstacles faced by the incumbent MDM provider by facilitating seamless and secure sharing of iPads between patients and between healthcare practitioners. Particularly, the constant turnover of junior doctors was causing the previous MDM provider headaches around reprovisioning devices. This was easily solved with Setup and Reset that allows any iPad to be personalized for any Apple ID.

Another future revenue avenue for JAMF within healthcare is the use of iPads for at-home care, whereby discharged patients take home an iPad to continue receiving care remotely. These needs are quite simple and it’s surprising how other vendors cannot satisfy such use cases. In essence, JAMF’s innate understanding and seamless integration with Apple management systems empowers them to decouple Apple IDs from Apple devices in a highly secure manner. Pretty much all other vendors are yet to catch up.

Growth in iPad Demand Summary

It’s apparent that the pandemic has kickstarted a technology awakening in education and healthcare. The surge in digitalization isn’t temporary or a one-time fix; the social distancing orders have compelled organizations to rethink the most optimal way to deliver services to enhance customer/patient experience whilst streamlining workflows. Although a big wave, 2020 is likely to be the first of a few waves of digitalization during the next decade. With this backdrop, iPad demand should remain strong and demand for simple and intuitive MDM solutions should be even stronger if organizations want to maximize the value of their fleet. From both a business and investment perspective, this puts JAMF in a very favourable position.