Full Report - JAMF - Great Alpha From Market Misunderstanding (3/3)

Market believes that AAPL will kill JAMF, while we believe the opposite is true.

Welcome to Covequity's Quick Takes— Timely interpretation of news & special events for cybersecurity and enterprise tech investors. If you are new, you can join our email list here:

This is the edited version originally from the discussion within Convequity on 22nd May 2021,

Sources of Alpha: Complexity of the Business

Expected Price Appreciation: 123% from $30 within 2 years

Executive Summary

Given employee PC choice trends, Apple’s push into business, and COVID-driven digitalization acceleration in education and healthcare, JAMF are in a prime position for the next 1 to 3 years.

The recent Wandera acquisition offers ample synergies for strong revenue performance.

~50% mispricing is attributable to investors assuming Apple’s acquisition of Fleetsmith is an existential threat to JAMF – we outline the very low probability that this is the case.

Contents

Article 1

Overview

Why Do Organizations Need and MDM?

Why JAMF?

Growth in Mac Demand

Growth in iPad Demand

Article 2

Competition

Is Apple a Threat?

Wandera Acquisition

Article 3

Revenue Sources Recap

Quantitative Revenue & Valuation Analysis

Conclusion

Revenue Sources Recap

We’ve covered a few growing revenue sources for JAMF so we wanted to pause for a moment and recap. Below we illustrate how the previously outlined drivers are good for JAMF’s business growth. Highlighted in gold text are the major revenue drivers and the factors to the sides of the top row of blue arrows are additional factors that will help drive solid business performance. Ultimately, we view these drivers/factors will lead to accelerated Mac and iPad growth and larger contract wins – all-in-all, the outlook looks very promising for JAMF.

Figure 11 - Growth Flow Chart

Source: Convequity

Quantitative Revenue Analysis & Valuation

Since Vista Equity Partners acquired JAMF in 2017, the business has been moving in the right direction on many fronts. Being the third largest-by-revenue software PE firm in the world, Vista have bucket loads of experience in extracting the most value out of software businesses. Until Vista came along, JAMF had great technology and expertise but lacked business strategy. Vista has spearheaded the firm’s tuck-in M&A strategy to garner greater appeal to specialist verticals and has reorganized the product portfolio to better showcase the breadth of JAMF’s offerings and so that customers can more easily browse and select to meet their requirements.

Quarterly Recurring Revenue ARR Analysis

Vista are also credited with helping JAMF migrate to the cloud, and in so doing, recurring revenue and ARR have sharply risen as a percentage of overall revenue. The table below shows how recurring revenue and ARR both represented 83% in 1Q20 and 1 year later has jumped to 92%. Much of this was driven by the WFH of the pandemic, however, had Vista not hurried JAMF’s evolution into the cloud, the business wouldn’t have been equipped to help existing and new customers adapt to remote conditions.

Figure 12 - Quarterly Revenue Analysis

Source: Convequity analysis

Another noteworthy insight from the above table is that YoY growth of installed devices has nearly doubled since 2Q20, yet revenue growth hasn’t accelerated by similar proportions. This could mean that JAMF has substantial ‘land-and-expand’ opportunity within recently acquired customers.

Also take note of the solid Dollar-Based Net Retention Rate (DBNR) during each of the past 5 quarters. This is evidence of a very healthy business whereby customers are increasing spend with JAMF – in the latest quarter, 1Q21, on average customers increased their spend by 17%. Once Wandera has been fully integrated, we anticipate that the DBNR will creep higher off the back of the wider scope of cross-sell opportunities.

ARR Multiple Valuation

In forecasting JAMF’s revenue we’ve taken two separate routes. We’ve projected revenues in our usual method: review a group of SaaS companies to forecast intermediate growth and then consider larger software companies for longer-term trajectories. Though given the additional data available pertaining to numbers of installed devices and price per device, we decided to project ARR as well and then use this for a back-of-the envelope valuation.

Below we present possible ARR in FY25 subject to the growth in devices and the increase in price per device. The yellow cells outline where we think the FY25 ARR is most likely to fall. 1Q21 installed device growth spiked up to 36%, though our conservative guess for normalized growth through FY25 is 15% to 20%. In the past 5 quarters JAMF hasn’t really increased their price per device – probably as a result of the hardships placed upon customers during the pandemic. But given that their premium reputation does bestow them with a fair degree of pricing power, coupled with our expected for moderate inflation, a 2% to 4% annual increase in price is likely, in our opinion. Based on this rationale, we believe an FY25 ARR within the yellow cell range is most likely. An average of these 4 highlighted ARR is c. $800m.

Figure 13 - ARR Forecast Analysis

Source: Convequity

Below we’ve taken the estimated $800m of ARR for FY25 and made a couple of assumptions to conduct a back-of-the-envelope valuation. As can be seen, in FY25 we’re assuming ARR will represent very close to 100% of total revenue, which is reasonable given the recent trend. And a second assumption is that JAMF’s P/S will be 8x. These assumptions equal a share price of $54.38 by the end of FY25, resulting in an annualized return of 13.3% from the share price at time of writing of $30.59. This indicates the stock is currently trading at a 43.8% discount to intrinsic value.

Figure 14 - Back-of-the-Envelope Valuation Using FY25 ARR

Source: Convequity analysis

Bear in mind that the $800m ARR for FY25 is a conservative estimation so in the sensitivity table below we highlight the intrinsic FY25 value per shares in gold to reflect more bullish outlooks for ARR. It’s also possible the 8x P/S is too optimistic, however, given the expected growth in FY25 along with the runway of growth from that point forward, it feels the most plausible out of the range.

Figure 15 - JAMF's Back-of-the-Envelope ARR Valuation Sensitivity

Source: Convequity analysis

DCF Valuation

Now we’ll briefly present snippets from the Convequity Valuation Model – the framework we usually apply to forecast revenue growth and FCF margin and then to discount the FCFs with an appropriate discount rate to arrive at a DCF valuation.

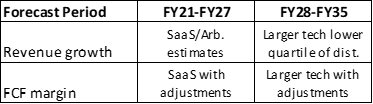

As you’ll probably already be aware by reading previous Convequity reports, we use a SaaS peer group to make forecasts for the next few years and a larger tech peer group to make longer-term forecasts. Both peer groups are older public stocks with typically greater revenues and hence they provide insight into JAMF’s possible future paths. In essence, these peer groups provide an anchor for our projections on the subject stock. And with these anchors, we make adjustments to reflect the likely reality on the stock under study. Below is a summary of our forecast framework.

Figure 16 - Forecast Framework Summary

Source: Convequity

From our deliberations we’ve projected the following revenue growth and FCF margin trajectory for JAMF through to FY35. Note that this version of FCF margin includes projections for M&A as a percent of revenue throughout the forecast period.

Figure 17 - JAMF Revenue Growth & FCF Margin Forecasts

Source: Convequity analysis

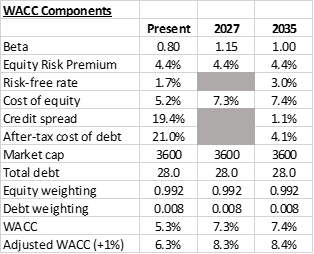

Below are the components of our WAC estimation. As a reminder, if you’re interested in taking a look at the valuation model to digest the full details of our method, email jordan@m.convequity.com and I’ll attach it in my reply email. From these inputs the calculated present WACC is only 5.3% due to a low beta, Equity Risk Premium, and low-ish risk-free rate. As this seems on the low-side we decided to adjust the WACC upwards by 1% throughout the forecast period.

Figure 18 - WACC Components

Source: Convequity Valuation Model

The following chart shows the valuation breakdown by time period, derived from the previously shown revenue growth and FCF margin projections and the WACCs presented above. This DCF process has derived an intrinsic value per share of $67.

Figure 19 - DCF Valuation Breakdown by Time Period

Source: Convequity Valuation Model

Relative Valuation

The chart below from the Meritech Capital shows EV/NTM Revenue multiples versus consensus NTM revenue forecasts for a group of SaaS/cloud stocks. We’ve circled JAMF to help you locate their position on the chart. Their position on the chart is based on the current enterprise value, or EV, and a consensus NTM revenue forecast of 21%, and by being under the dotted diagonal line the stock can be construed as relatively undervalued. Although, as we’ve outlined in this report, a NTM growth closer to 30% is more realistic given the various tailwinds and drivers. This would push out their position on the scatter chart to the purple circle. And as this is further away on the underside from the dotted line, this indicates more relative value. In fact, if the purple circle is where JAMF should be positioned, then JAMF is the furthest away from the dotted line and hence offers the best value of the entire group.

Figure 20 - SaaS/Cloud Stock Multiple Comparison

Source: meritechcapital.com, Convequity modification

Valuation Summary

We’ve assessed the value of JAMF’s stock with 3 approaches: an ARR multiple valuation, a DCF valuation, and a relative valuation. Here is a summary:

Figure 21 - Valuation Summary

Source: Convequity

Based on our analysis we project that JAMF’s true value is in the range of $50 to $70 per share offering 1.6x to 2.3x upside from the share price at the time of writing ($30.38). And we think the stock could be trading in this range within the next 1 to 3 years.

Conclusion

There is a significant (~50%) mispricing to exploit in JAMF’s stock as a result of a superficial understanding of Apple’s probable intentions in regards to MDM. Various angles indicate Apple will very likely just integrate Fleetsmith in order to improve their fragile and extremely limited Profile Manager for the basic onboarding of SMBs and to help improve their MDM experience. Perhaps the acquisition will also be used to improve API integration with more large-scale MDM providers to help them better serve complex enterprise use cases – after all, this will serve the ultimate goal of Apple gaining share in the enterprise segment a lot quicker (and more successfully) than if they chose to do it alone.

Asides from the gross mispricing, we view JAMF as a solid long-term investment. JAMF is the number one BoB Apple MDM, major tailwinds are in their favour, they’re sustaining 30%+ growth, and with Vista backing them they will continue to increase profitability.