Full Report - QCOM - Connectivity is the Future (2/2)

This is the second part of QCOM analysis, focusing on the valuation

Welcome to Covequity's Quick Takes— Timely interpretation of news & special events for cybersecurity and enterprise tech investors. If you are new, you can join our email list here:

Sources of Alpha: Complexity of the Business

Expected Price Appreciation: 100% from $180 within 3 years

Link to Article 1:

Valuation Considerations

Let's start the valuation exercise by briefly summarizing our understanding of QCOM's competitive positioning:

QCOM's Android Advantages

Android platform – number one choice, especially higher-end Androids [5G enabled], as there is no legitimate competitor due to QCOM's dominance in the modem.

Modem-RF - QCOM is the best without any potential competitor but possibly AAPL in 2023 when it introduces its own modem.

Mobile gaming – QCOM is second to AAPL's by a wide margin.

WiFi – QCOM has the best WiFi technology.

Mobile sound – QCOM is second to AAPL's by a wide margin.

Mobile AI – QCOM is significantly weaker compared to NVDA, AAPL and possibly GOOGL.

Camera – QCOM has best camera due to its status as the only choice for premium Android phones. Based on absolute processing capability and software, it is weaker than GOOGL's.

Battery life – QCOM is second to AAPL.

CPU – QCOM has the second best CPU but it’s based on publicly available standard Arm license that lags AAPL's custom Arm CPU by c. 3 years. Nuvia could change this, however.

In our opinion, QCOM is still the de facto monopoly in the Android SOC space.

Keep in mind that QCOM's best chip lags the iPhone’s in terms of gaming and CPU by 2-3 years. And QCOM's battery life and AI capability are also significantly inferior compared to Apple's A-series custom mobile chip.

Snapdragon vs Apple Silicon is like the Intel vs AMD of the PC era, though this time AAPL is a stronger competitor with great software and hardware integration.

QCOM's Automotive Advantages

Best telematics [a GPS or other data logging tool used to track vehicles, etc.] and best connectivity

Infotainment cockpit assets

Arriver acquisition [purchased the computer vision & driving policy from Veoneer], and others

Nuvia – could possibly create a competitive edge in the server market providing compute to the automotive industry.

QCOM's core advantage in automotive, is again, the connectivity. In order to allow your car to get connected to the internet, you need a modem and QCOM is the only choice. TSLA, in a similar vein to AAPL in smartphone space, builds its own chip for the car but it still has to buy QCOM's chip and licenses.

QCOM is also taking a more friendly move in its licensing practices, switching from percentage-based royalties into dollar-based licenses. Previously QCOM charged royalties based on percentage of the car's price, which would be highly prohibitive for premium cars like Mercedes' and BMW's.

By taking a more cooperative stance, QCOM is able to better cross-sell its SOC to car vendors, instead of selling modem chip only. Again, a very close parallel to the smartphone era.

NVDA seems to be focusing on high-end cars with a focus on AI. The market is pricing in NVDA’s success in the auto market to almost perfection – meaning any slight disappointment and the stock could plummet.

However, there are two issues:

1) NVDA's system seems to be at the infrastructure level, while the software and others are still needed for car makers. And that's the weak spot for legacy manufacturers compared to newcomers like TSLA, as they are not good at designing a great digital infotainment experience compared to tech savvy firms like TSLA or smartphone vendors. QCOM's edge in the smartphone could be transferred to auto.

2) NVDA lost the smartphone SOC space to QCOM in the last decade for the exact same reason - modem.

Unlike VR, there are tons of startups focusing on AI chips and chips for autonomous driving. In our judgement however, none of these brands can compete with TSLA on ADAS [Advance Driver Assistance Systems] or QCOM on the infotainment front. For vendors without the capability like TSLA to design their own, NVDA is largely a second choice to QCOM for infotainment. We certainly think that wireless and connectivity for cars could be underestimated relative to the autonomous driving hype that is really a technology that will come to fruition further into the future.

QCOM is also expanding its presence in auto with the recent Arriver acquisition - a company focused on high precision road mapping. Road and vehicle communication is another important future development and it could be even more important than AI in the world of AD.

Nuvia could also help QCOM bring a better CPU to the market compared to NVDA who is acquiring Arm and going to use standard Arm core. If Nuvia could deliver its promise, QCOM could have 2x-3x performance compared to NVDA.

QCOM's PC, VR, IoT & Others

The convergence of mobile and PC is the inevitable trend, and QCOM is primed for this. If Nuvia could deliver the promise, then QCOM can not only provide the best connectivity but also beat AMD and INTC on the CPU front. This could help QCOM rival against AAPL using its Arm chip, and help MSFT switch the ecosystem from x86-based architecture [like the chips of AMD & INTC] to an Arm-based architecture, which seems to be the long-term trend.

AAPL leads new developments in AirPods, watches and IoT devices. QCOM provides the chip for competitors to play against AAPL. As these new areas stress the importance of mobility and connectivity, QCOM's specialty is a deep moat again. Furthermore, with its prior success in building a smartphone ecosystem centred around its SOC as the brain, QCOM could lead the industry with its design standard and upper stack SDK [Software Development Kit] again.

Overall, the inevitable trend for all machines is the increase in connectivity and QCOM is the only choice from a client device perspective. As such, we believe QCOM's bottom line is well supported and its upside seems to be unlimited.

Multiples

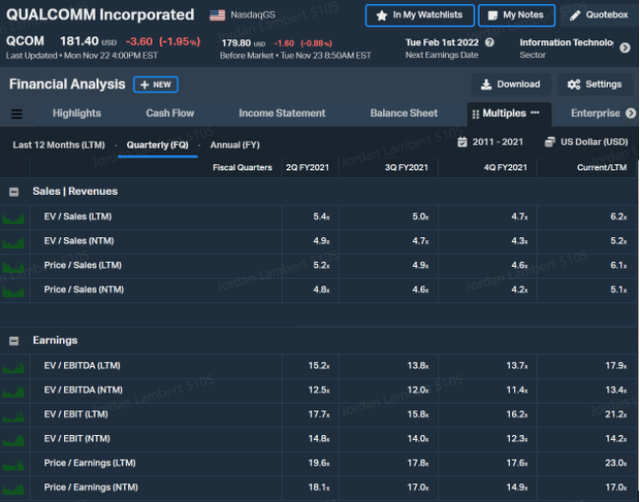

With share price standing at c. $180, market cap of $203bn and EV of $207bn, QCOM is trading at 6.2x EV/S LTM and 5.2x EV/S NTM with EBITDA margin at 33.88%.

From the EV/S perspective, QCOM is trading in line with lower growth semiconductor firms and we believe NVDA at 32x+ EV/S LTM is an outlier but looking closer to SaaS like valuation.

From the EV/EBITDA perspective, QCOM is priced fairly at the historical SPX norm around 16x. We believe this gives QCOM a good margin of safety and good backstop. However, also bear in mind that QCOM has been hated by investors in the past few years and it is not impossible to see its EV/EBITDA and P/E dip further into 12x-15x subject to negative sentiments.

DCF and Forward Expectations

Note – QCOM’s fiscal year ended 30th September.