AVGO + VMW - Value In The Rough - Part 2

Summary

Despite legacy associations, AVGO is a well-managed company. The vision and execution of management is among the rarest in the semi industry.

We expect AVGO's operational excellence to generate continued synergy from its M&A strategy.

Due to complexity, we think AVGO may continue to trade at a low valuation, paving the way for lower volatility, and higher returns driven by earnings surprises.

Risks to the thesis are: execution, cyclicality, and potential disruptors.

This is Part 2. Part 3 and Part 4 will be published in the next few days.

Intro

In Part1 published in August 2022, we analysed the merits and thesis behind AVGO's acquisition of VMW. We are bullish on the potential of the deal and believe it will benefit VMW investors to hold onto the shares of AVGO after the deal completes - scheduled for the end of October 2023.

The problem for investors, however, is that AVGO is a vastly different company. Compared to VMW, AVGO has a way higher revenue base, a much wider product line, and a very different industry. We think it is probably too complex for most general investors, or even Wall Street analysts, to cover the wide variety of products and appreciate the value of the company.

Moreover, its recent endeavour into the infrastructure software business, via the acquisition of Symantec and CA technologies, further complicates the picture as analysts covering AVGO are focusing on the semiconductor sector rather than the broader enterprise software.

The combined entity will be even more challenging for investors, and we expect it to be undervalued, in a similar vein to PANW, due to complexity and mischaracterisation. Thus, this could also be a great alpha opportunity for investors who are able to take the time to drill deeper into the company. We anticipate the long-term appreciation will be driven by continued earnings surprises amid low valuation, and possible bonus returns via multiple expansion.

AVGO History

AVGO is the driving force behind M&A consolidation that has been a major influence on the semiconductor industry for the past decade.

AVGO's ticker itself is the acronym of Avago, while the company name is Broadcom. Avago was once the semiconductor products division of Hewlett-Packard, back in 1961. Hewlett-Packard spun off its Medical Products and Instrument Group in 1999, named Agilent Technologies, as an independent publicly traded entity. Following the Dot-com burst, Aligent sold its semiconductor business, which is mainly about communications and networking, to a group of PE investors led by KKR and Silver Lake for $2.6bn in 2005, with $2bn in revenue and 6,600 employees at the time.

The PE consortium managed to find one promising executive, Hock Tan, BA of mechanical engineering from MIT and MBA from Harvard, to run the business as CEO. The name given to the business was Avago. In 2008, AVGO spotted the fire sale opportunity to buy Infineon's Munich-based bulk acoustic wave business (RF filter design team) for only EUR 21.5m. This is the first time that AVGO spotted the great potential of leveraging M&A for growth. Following the turnaround, AVGO went public in 2009.

In 2014, Hock Tan accelerated the M&A spree in both scale and frequency. That year, he levered up the company with $4.6bn of capital from bank loans, and $1bn of convertible notes from Silver Lake, to acquire disk controller juggernaut LSI for $6.6bn, doubling the run rate to $4.9bn. As you can see in the chart above, AVGO was highly effective at deleveraging and reducing the Total Debt / EBITDA ratio. This was achieved by selling the solid state storage controller business, SandForce, with ~$150m of revenue, to Seagate Technology [STX] for $450m, and LSI's Axxia wireless networking chip business with $113m of revenue to Intel for $650m.

Also in 2014, AVGO acquired PCI-E chip and switch maker, PLX Technology, for $309m. PLX is a strong innovator in PCI-E space with a vision of replacing the top of the rack switch using PCI-E links. A few years later in 2015, AVGO acquired Fibre Channel and Ethernet adapter card maker Emulex, with ~$450m of revenue, for $609m. Broadcom tried to buy it in 2009 but failed.

In 2015, Hock Tan continued to shock the industry with the humongous $37bn acquisition of Broadcom, which is the largest ever acquisition in the semiconductor industry. The goal was straightforward - to build the third largest chip maker via combining the 6th and 9th largest together. Furthermore, it was about unlocking Broadcom's operating leverage to increase the operating margin from 24% to 40%, whilst continuing to deliver 5% organic growth. And Broadcom's killer first-generation ASIC Tomahawk was just about to begin shipping, ready to disrupt the high performance DC networking market.

The buying spree continued in 2016, when AVGO acquired Brocade, the Fibre Channel and storage area network [SAN] leader, for $5.5bn. Around the same period, INTC's DC group generated about $18bn in revenue with 45% operating margin. It was also expanding everywhere - buying FPGA, wireless technologies, storage, and even ethernet switch. The most impressive part of AVGO M&A story is that Hock Tan is able to bring in various weak, small, yet niche dominant chip vendors all together, grow the revenue, and achieve better economies of scale. These vendors typically have less than 50% gross margin, 30% operating margin, and overall weaker profitability and scale versus INTC. After several years of M&A, AVGO becomes the DC fabless giant that is able to rival INTC from the networking side with a similar level of revenue and margin profile.

Avago-Broadcom To Take On Intel In The Datacenter

The M&A became increasingly audacious. In 2017, Hock Tan made a $117bn bid for QCOM, which at that time was in deep trouble with antitrust scrutiny and lawsuits, as well as having troubles with its leadership. This was another bold, contrarian, yet smart deal. While QCOM shareholders loved it and trusted AVGO's management to unlock value, it was a hostile takeover. Back then, QCOM's management was under the control of the founding Jacobs family. Despite the opposition, Hock Tan made every best effort to push through the deal including active PR and letters to regulators. To reduce the risk further, Broadcom was to re-domicile to the US in 2018. The deal was close to success, but the Trump administration blocked the deal in March 2018, citing national security concerns, influenced by the Jacobs' lobbying.

In 2018 and 2019, Hock Tan made another bet; this time on CA Technologies and Symantec. These two deals confused analysts way more than the previous ones did. AVGO was primarily a chip business, not a software business, and CA and Symantec are the legacy software businesses that are believed to be destined to marginalisation. AVGO paid $18.9bn for CA with a $4bn run rate, and $10.7bn for Symantec Enterprise division with a $2.5bn run rate.

This lively M&A history outlines the ambitious plans of AVGO to become the giant in infrastructure, as it pertains to networking and storage. They've acquired key technologies for chips, Ethernet and fibre, switches and routers, wireless technologies, and storage - everything to power a cutting-edge DC.

The incoming VMW deal will further transform AVGO. Overlaying VMW's leading software on top of AVGO's infrastructure, consisting of accelerator chips and supporting hardware, enables the combined entity to control the most valuable parts of the value chain, serving cutting-edge and legacy enterprise customers, alike.

Products

AVGO is probably the most complicated company to cover for us and other technologically focused research analysts. It is the original creator and has been driver of the consolidation play in the semiconductor industry for the past two decades. It is also expanding into the software space, which is historically a distinguished sector relative to the software industry. To simplify the research, we will be focusing on higher level insights instead of diving deeper into the individual businesses and the competition. Fortunately, our prior research work on semiconductors, cybersecurity, and enterprise tech in general, helps us get an understanding of AVGO's main area of business, which we hope benefits our subscribers.

Source: broadcom.com

AVGO's core product is networking chips, related accelerator ASIC chips, and infrastructure software. Its bread and butter chip is the Tomahawk series for DC ethernet switches, which need a highly programmable and performant chip. It also offers router and network interface card [NIC] chips for DC servers to communicate with each other.

Furthermore, it has a sizable revenue stream from silicon photonics and fiber that allows DCs to transmit data faster via photons as opposed to electrical currents via copper cable. These are the chips procured by DCs and built and operated by cloud hyperscalers like AWS and tech giants like Meta. This enterprise networking, or Metro/Core (that is the core network that processes traffic coming from RAN all over the place) plus On-Prem/Cloud shown in the chart above, represents c. 50% of AVGO's revenue.

AVGO also generates substantial amount of revenue (about 25%) from supplying chips to consumer or subscriber related use cases, as depicted in the chart above. This includes providing chips to Internet Service Providers [ISP] like Verizon or Sky, which offer internet connectivity to consumers. It includes chips within an ISP's infrastructure, like cell towers that send signals to mobile devices, and broadband servers that connect to residential broadband cables. It also includes devices that ISPs send to residentials, including routers, WiFi APs, and OTT (over-the-top) TV boxes. Lastly, this also includes chips in mobile devices that receive mobile, WiFi, and Bluetooth signals, and decode it to the CPU.

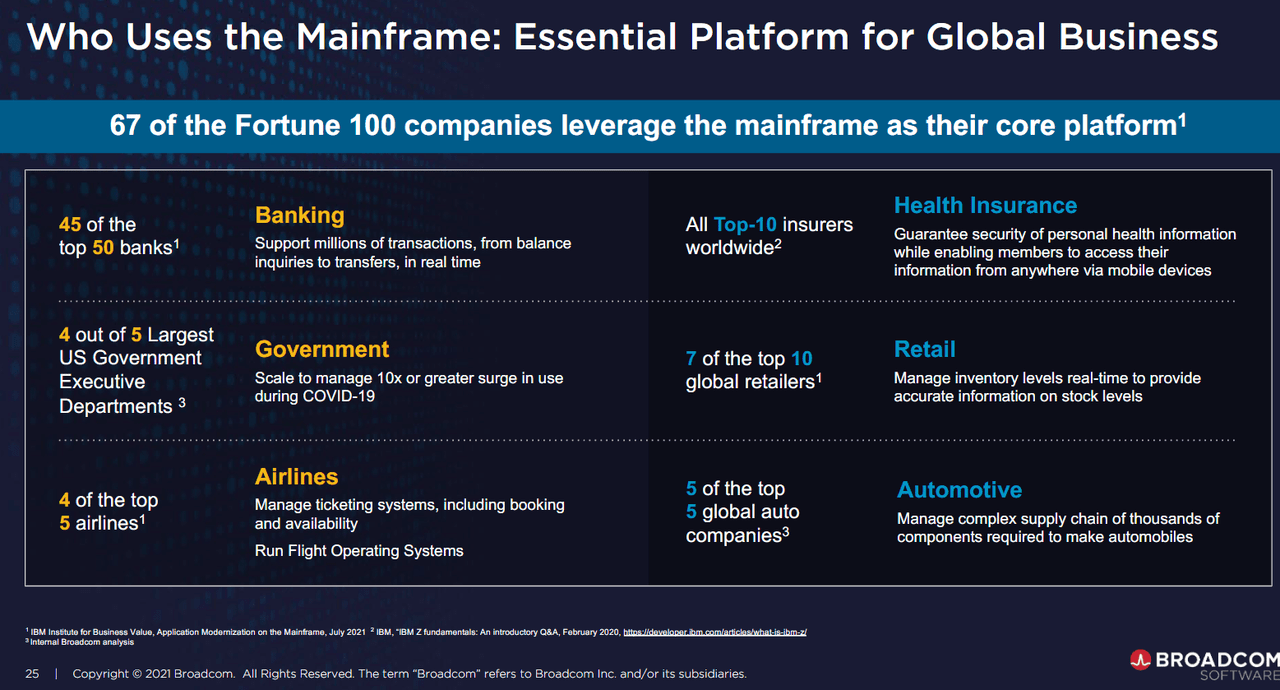

Finally, AVGO also has c. 25% revenue coming from infrastructure software. AVGO's Symantec acquisition brings in a suite of cybersecurity tools to secure enterprise network, device, and data. AVGO's CA Technologies acquisition brings in a suite of management tools for mainframe servers, a marginal yet still critical category of specialised computer for handling financial transactions.

AVGO Management, Vision, and Execution

Consumer & Mobile Networking

Broadcom's root is the consumer-related networking chips that are virtually everywhere. Its channel relationship and continued investment in evolving its products to the latest generation has made it a successful business. BCM (code name for Broadcom chips) chips are known for their reliability and performance in home routers and OTT TV boxes. Broadcom's execution here is truly BoB. Apart from some penetration from QCOM's Atheros WiFi+Bluetooth combo with RF bundling and SOC, Broadcom's leadership in broadband, home routers, and mobile device connectivity chip, is unquestioned.

This is thanks to its ability to deliver the latest generation of chips supporting the latest standard. For example, Broadcom announced the first successful implementation of WiFi 7 in Sep 2022. There are numerous cases where AVGO simply leads the industry forward, and growing business lines steadily as a result. The most notable one was its close collaboration with AAPL in the mid-2000s, when it was developing iPhone.

AVGO foresaw the tremendous amounts of value behind WiFi and Bluetooth technology, and hence seeded chip investment to develop wireless connectivity chips for iPhone and mobile devices, while INTC stepped away due to lower profitability versus its CPU lines of business. In the past decade, AVGO and QCOM are two of the biggest winners thanks to the mobile revolution, with the former in the RF, Bluetooth, and WiFi connectivity space, and the latter in the modem and Android SOC space.

DC Networking

The bet over consumer and mobile networking has cemented AVGO's initial success in the last decade. AVGO's investments in DC networking has the potential to serve its next wave of growth in the coming years.

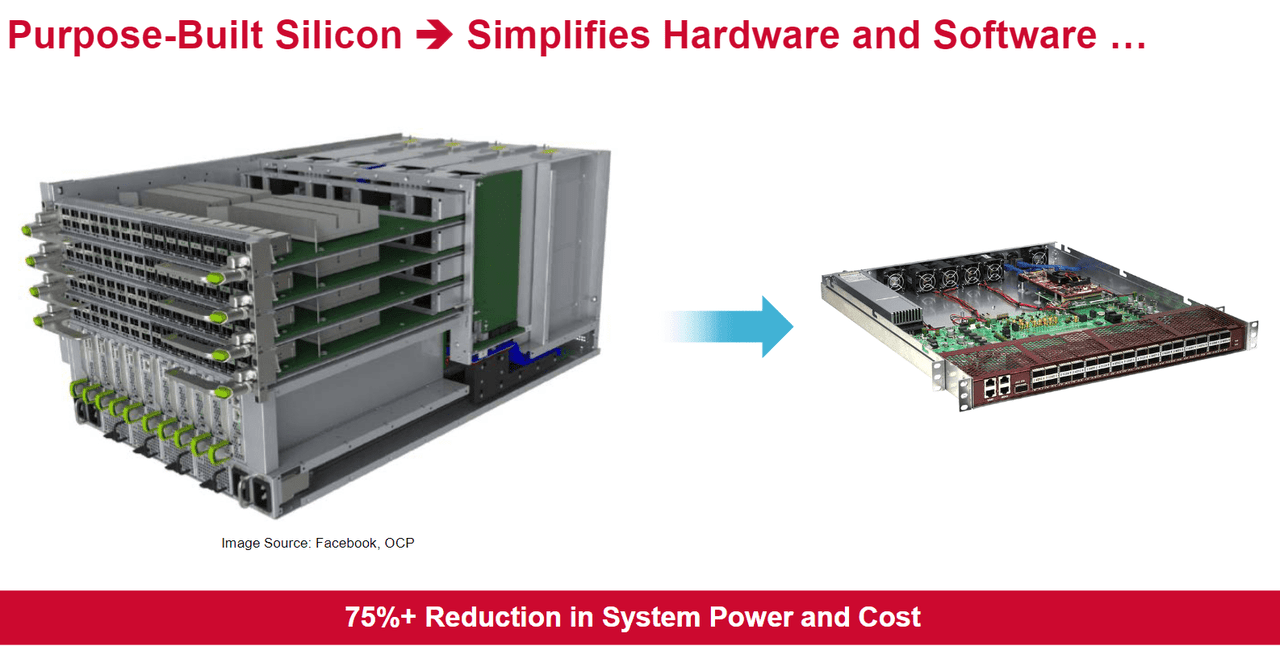

The rise of hyperscalers, and tech giants like Meta, requires a new DC networking infrastructure that is highly programmable, cost-effective, and performant.

Performance. As you may notice from our AWS analysis, high speed interconnects between servers within cloud is a core differentiator relative to traditional VPS businesses that are more commoditised with lower margins. In fact, the wild success of SNOW, that leveraged the separation of compute and storage, is not possible without this high performance networking. Without the ability to send huge amounts of data from centralised object storage to multiple compute clusters, Massive Parallel Processing [MPP] of data is impossible.

Programmable. Cloud is multi-tenant and customers build their own virtual private cloud and networking on top of hyperscalers' infrastructure. The underlying infrastructure has to be highly programmable to serve the highly dynamic networking requirement. Furthermore, hyperscalers like AWS, with more than 120 services, also require the networking to be more flexible and agile to enable faster time to market and speed of innovation.

Cost-effective. Cloud requires connectivity at 10x-100x of the traditional DC, and vendors like AWS need to keep pushing the price down every year while keeping 60%+ gross margin. This requires them to squeeze out every bit of cost improvement and figure out where they can lower down the cost via scale and custom designed infrastructure.

Traditional networking vendors like CSCO are too rigged to change as they have gotten used to selling pricey networking boxes with limited configurability to keep the margins high. Vendors like Meta proposed an open Software Defined Networking [SDN] framework that caters to their unique needs. The idea is that with such great scale and specialised specifications from the buyer side, the hardware box should have a standardised form factor that every manufacturer can produce. And by commoditising the hardware, the software networking operating system can run on top of any hardware box and handle the unique demands from different companies. In essence, SDN is about decoupling the hardware and the software, and allowing software to control numerous different hardware boxes.

This is clearly not in CSCO's favour as it means less room for margin in its hardware productions, and less moat as it doesn't control the software component anymore. Meanwhile, vendors like Meta and AWS are finding it difficult to build the performant hardware without network ASIC, and CSCO simply won't sell them without bundling them with its hardware box and software.

To put it in a simple analogy, it is like you having to buy a separate device for watching YouTube, and another dedicated device for running WhatsApp, while in theory, you can run two or more apps on the same device. However, as a device manufacturer (like CSCO), this means you lose more revenue by giving customers more choice and flexibility in running the workload.

AVGO spotted this opportunity and forged a strong open alliance across all parts of the ecosystem. This included hardware platforms like Arista Networks (ANET), that built its own networking operating system - theArista Extensible Operating System [EOS] - which combined withAVGO's chip to take down CSCO in use cases like high performance compute [HPC] and high frequency trading. The most amazing part of the story is that this eventually forced vendors like JNPR and CSCO to be a customer of AVGO.

VMW is another huge beneficiary. Together with AVGO's chip, and commodity server racket OEMs like HPE and DELL, as a pure software vendor, VMW is able to beat CSCO by offering NSX SDN software to customers. Under Pat Gelsinger's vision and execution, VMW bought Nicera for $1.26bn in 2011, which was considered to be an overpriced deal for a nascent startup. This eventually turned out to be a more than $2bn revenue business and shook CSCO's firm control over enterprise networking.

Similar to QCOM and NVDA, AVGO's secret source here is its comprehensive API and SDK support for software developers building networking functionality into applications on AVGO platform. AVGO has made it super easy and convenient for developers and operators to build infrastructure software catering to their unique demand, while offering different ASICs with varying degrees of extensibility and performance.

Like its mobile business, we're also impressed by AVGO's execution of innovation as it keeps on delivering the latest generation of chips, leading the rest of the competition by several quarters if not years. High speed innovation plus architectural vision enables AVGO to not only deliver better flexibility to end users but also crush integrative vendors like CSCO in terms of cost.

AVGO's investments in this field will be a powerful driver of its growth in years to come. With cloud and digital transformation continuing to have a heightened and more critical demand, AVGO's leading status in SDN will continue even more so after the VMW acquisition.

SAN, Photonics, and Others

There also numerous trends that play in AVGO's favour, and it is either early in seeding the trend while others are late, it has a clear monopoly with respect to market share, or both.

https://investors.broadcom.com/static-files/f3873d3c-6d81-4795-ae54-b8b2330a27d8

Although HDD (Hard Disk Drive) is in relative decline versus SSD (Solid State Drive) in the client (phone, laptop, or desktop), it is clear that to drive costs lower while serving the ever-increasing need to store data in the cloud (SNOW, Databricks, and others), a huge amount of HDD for nearline storage is required. This save costs from online SSD disks (10x+ more expensive) while preserving the readability for quick retrieval relative to offline tape storage (1000x+ more latency). AVGO has supplied pre-amplifer and SOC to all three major HDD vendors. It is the preferred vendor to work with. This is because it is a legacy business with many decades of history, running out of room for improvements. Hence, we don't think there will be a new startup to disrupt this old yet still growing sector. Again, this is a very similar set up to AVGO's software business in the sense that the public believes the industry is dead, but if you take a closer look, there is still ample room for organic growth and TAM expansion with way less competition and disruption risk.

SAN and Fibre Channel are also great businesses for AVGO. The space has consolidated a lot and won't have a disruptor in the foreseeable future. Through acquisitions, AVGO has kept all BoB point solutions in its portfolio, and bundled it with ecosystem support. It has 70% market share and almost monopolistic dominance in the high-end products. The most admirable aspect is that AVGO doesn't introduce shocks to the BoB companies acquired. Under AVGO, PLX, Emulex, and Brocade, continued to innovate because of greater platform cross-sell and unified support.

AVGO is also actively seeding the emerging silicon photonics space. As networking bandwidth continues to grow, the traditional copper-to-copper lines do not scale sufficiently. For 40gbps or higher, the copper cable faces higher decay and is unusable for 4 metres or longer, which means that it can't even connect the switch at the top of the server rack to the servers below. AVGO's latest Tomahawk 5 switch chip, released in August 2022, is the first to co-package a photonics optics connector with the chip.

We believe this leads the rest of the industry by 2 years or more. And the moat is deepening, as the number of vendors that can afford to combine switch silicon, mixed signal IC, optimal devices and fabs, advanced packaging, and silicon phontonics, all together, will shrink dramatically. Funny note though, AVGO's current sample is based on INTC's optics receiver as AVGO's is not online yet. INTC's IFS could land AVGO as a key customer like it did with CSCO, especially considering IFS has better packaging and photonics technology compared to TSM.

CA and Symantec

AVGO's acquisition of Symantec struck cybersecurity and software analysts as a dumb deal. Both CA and Symantec are notoriously legacy software companies that don't grow because they don't innovate. Under professional managers instead of founders control, they kept enlarged headcounts consuming high and inefficient opex. They buy tons of promising startups at a high premium, and laterally force visionary talents out because of bureaucracy and lack of empowerment. The public entity is basically turned into a nursing home for engineers looking for retirement but pretending to be at work.

Symantec's enterprise business had about $2.5bn of revenue, but close to nil in operating profits, while its consumer business had about $2bn in revenue and contributed most of the profit for the group. This is because the enterprise business is a high-touch business whereby, for example, they need more headcount to support one secure web gateway client compared to the headcount required for 1,000 consumers that are using pre-installed endpoint protection software.

https://investors.broadcom.com/static-files/8a9c8a85-5ab6-4ff7-80e7-7af1482ea0b5

There are two ways to fix the issue: either a complete turnaround from the ground up by a powerful leader to revive innovation and growth (grow the top-line), or a partial turnaround that focuses on trimming down the free riders and growing the bottom-line. The first way is more risky and harder, experienced by Pat Gelsinger as he executes the heavy lifting at INTC. The second way isn't any simpler as there is no precedent other than some PEs like Thoma Bravo and Vista. (However, it has been the secret sauce of the stellar returns of Thoma Bravo).

AVGO spotted this contrarian opportunity and clear ROIs upon successful execution. We surmise that we were amongst the analysts who turned bearish over AVGO without looking what's going on under the hood. We were shocked to learn that Symantec, in 2020, decided to focus only on the top 100 customers and leave the rest of the customer base in dismay.

The strategy, despite poor public reception, performed nicely for both shareholders and enterprise customers. This is especially the case for CA Technologies, whose mainframe software business is in a very stable demand and competitive situation. Although cloud is the future growth area for workloads, mainframe isn't going away. The natural demand and spending on mainframe will continue to grow at low-single digits. CA is competitively positioned against IBM, that is now the only manufacturer of mainframe hardware. Therefore, we are not surprised to see that AVGO is able to create value via driving the GM to 90% and 70% operating margin. This is very much like the business of utilities whereby the demand is steadily increasing in line with GDP, and the competitive landscape is stable without any radical change in technologies (nuclear power for example), thus supporting high operating margins.

The same could be applied to Symantec though the competition is higher. Symantec enterprise security is clearly playing on a weaker hand relative to next gen vendors, including ZS for secure web gateway, PANW and FTNT for NGFW, S & CRWD for endpoint security. However, it seems like a fair number of large enterprises are satisfied with the on-prem and legacy security offered by Symantec. As a result, after strategic refocus and trimming down expansive headcounts, Symantec enterprise security is able to grow at low-single digits while sharply increasing the operating margin.

In Part 3 we'll review growth by acquisition and examine AVGO's particular playbook. In Part 4 we'll discuss AVGO's future and competition. Both will be published within a few days.