Perspectives - AMZN - AWS Undervalued

Amazon Web Service (AWS), the AMZN's strongest business arm, seems to be outright undervalued.

Welcome to Covequity's Quick Takes1— Timely interpretation of news & special events for cybersecurity and enterprise tech investors. If you are new, you can join our email list here:

Sources of Alpha: Complexity of the Business

Expected Price Appreciation: 100% from $3300 within 3 years

Executive Summary

AWS is the most profitable and strategically important unit within AMZN, contributing c. 30% revenue and c. 80% of operating profit. However, its valuation is widely believed to be under $1 Trillion.

What's been underappreciated and yet to be priced in is AWS's strong competitiveness. In this post, we analysed a few aspects contributing to AWS's deep moat - its product differentiation, its startup engagement strategy, and its culture and leadership.

We will also briefly discuss AWS's future and how it is going to unfold under the competition with other hyperscalers.

AWS - defining the IaaS and relentless differentiation

In 2004, Andy Jassy - now the new CEO taking over the founder Jeff Bezos - led the then nascent effort to better utilize AMZN’s excess capacity built for peak hours of activity on its e-commerce sites. The rest is history - years later, AWS is now a giant business with ARR [Annual Recurring Revenue] at $64bn and 30%+ GAAP operating margin. Every year tons of new features and products were added.

EC2 and VPS

The most important service is AWS’s EC2 [Elastic Compute Cloud], that allows developers to instantly open up a new virtual machine using automated APIs or manually with a few clicks and pay for the consumption on a usage basis. As there are X many VMs per hardware, VM users are sharing the underlying computing power.

Sharing compute resources isn’t new, however. Even before the advent of personal computers, the mainframe and earlier forms of computers were expensive giant machines that were offered to researchers and the public on a time-share basis.

Pooling and disaggregating resources has been the keystone for lots of businesses. In the 1990s/2000s, prior to EC2, there were various other ways to share compute resources, including Virtual Private Server [VPS], Dedicated Hosting Service [DHS], and Colocation. Here, we outline the differences among these services:

A simple analogy could be, a private data centre is like building and owning your own apartment building, colocation is like renting an apartment without furniture [got to add in your own hardware]. Dedicated hosting service is like renting an apartment with furniture [hardware already available for use]. And VPS is like renting a room and sharing furniture [hardware] in one apartment, and depending on the occupancy, you may need to wait for the bathroom and kitchen [hardware resources such as compute].

The proliferation of VPS came in c. 2000 when VMW released its first hypervisor ESXi. This allows operators to buy hypervisor software licenses and virtualize [partition] the physical machine into scalable pieces of instances. In many ways, EC2 is similar to VPS as the end product is a virtual machine instance. However, AMZN has made numerous tweaks to make it more suitable for modern-day digital infrastructure operations. Most notably, EC2 provides mission-critical features not available on VPS. These include optimized variants [choice of instance type – optimized for compute, optimized for storage, optimized for memory, or general purpose], high availability [hardware redundancy to ensure 99.99% system uptime], data durability [ensuring access to uncorrupted data], high scalability, on-demand pricing, and high connectivity.

The key here is that EC2 instances run on top of a cluster of servers interconnected and virtualized - hardware failure of one physical server won't significantly impact the availability of operations. With internal [east-west] hyperconnectivity, developers can also utilize more sophisticated design and topology. As such, EC2 has evolved VPS into Virtual Private Clouds, hence the product name Elastic Compute Cloud.

Strategy - In-depth Engagement with Startups

AWS started just around the time when the hypervisor technology was making virtualization possible and the demand for Internet/web services began to bounce back following the dotcom crash. So, as the technology was already available, the harder challenge was executing an effective GTM [Go-To-Market] strategy. Consequently, Jassy and his team focused their energy around helping startups building applications with high engagement to begin carving out a market and simultaneously to improve and build new AWS products.

This strategy has paid out handsomely, showing up in AMZN's financial results years later at an accelerating speed. Startups that quickly scaled into unicorns, were increasingly contributing to more and more consumption on AWS’ IaaS. Take DBX for example, the company was founded in 2007 and thanks to AWS it managed to scale and meet demand to the point where it’s AWS bill was $100m+ by 2014. This is one of innumerable examples of startups scaling with AWS at a rapid rate and the number of startups growing with AWS is showing no sign of slowing down which has led to AWS’ unstoppable growth even at a staggering $60bn in ARR.

Unstopped Differentiation

Furthermore, startups are also the ones leading the cutting-edge in application design, and as such, their demand for infrastructure will forerun the general public by 3-5 years. By partnering and helping startups, AWS also pioneered the industry with lots of new products to compliment EC2 and together further differentiates the seemingly commoditized IaaS business.

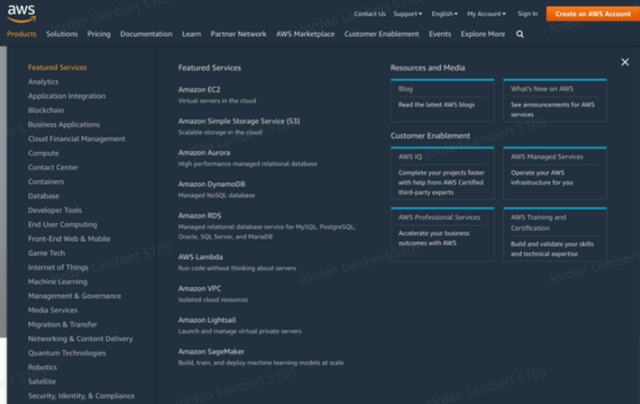

Here we outline some key products:

S3 [Simple Storage Service] allows storage to be abstracted from servers. With S3, developers no longer need to configure error correction mechanisms and because of the abstraction storage has been decoupled from other resources, meaning developers don’t need to pay for CPU, memory and networking hardware.

EBS [Elastic Block Storage] allows multiple EC2 instances to share one abstract common storage device, allowing for greater interoperability and hence greater ease of use for developers.

ELB [Elastic Load Balancer] allows the traffic to be routed along the most optimized path, helping developers to achieve higher utilization or higher performance.

AZ [Availability Zone] and VPC allows developers to build applications with high availability and security without the need to manage complex physical infrastructure.

These products work with each other nicely and compounds the benefits for developers creating and deploying their applications. For example, EBS can take snapshots of existing EC2 instances and automatically recover the work if unexpected errors happen. In using AZ, workloads can shift to another availability zone with IP, storage, and other status remaining unchanged, thus freeing up developers from complex configuration changes when an outage occurs.

Startup-like Culture and Intelligent leadership

These aforementioned innovations have materialized because of AMZN's talents, leadership and culture.

A customer centric philosophy is deeply rooted within AMZN's culture and this leads to greater customer satisfaction. Furthermore, Bezos requires all AMZN internal projects to use AWS and to give equal footing to internal and external clients.

Aside from innovation, cost leadership is another key component of AMZN’s positioning strategy. AWS keeps on delivering better product, faster performance, whilst lowering the price every year. With higher volume, the scale economies enable AWS to attain higher margins. Per our proprietary research, AWS' core product EC2 is highly profitable - the contribution margin generally stands at 70%+. Even for the lowest utilized SKU [Stock Keeping Unit], AWS is still able to make 30% out of it. Part of the reason for this is that AMZN is headquartered in Seattle instead of Silicon Valley, thus it has accumulated lots of engineering talents with lower labour cost and greater diversity.

From AWS’ onset, a relentless endeavour to limit bureaucracy and preserve the startup mentality has resulted in superior growth momentum even at a huge revenue base. Bezos, Jassy, and the AWS team have made numerous rules to the team in a quest to keep a tight control over the culture. Two of the most notable ones are the "Always Day One" slogan and famous Two Pizzas Rule which dictates that every meeting should be small enough that all attendees can be fed with two large pizzas.

This startup culture combined with empowerment and a highly customer centric approach to product development, is a huge catalyst to growth. Product decisions can be made by the lowest levels of the AWS hierarchy, which capitalizes on the small teams who have frequent in-depth interaction with real users - often the startups who have the most novel and cutting-edge demand. We believe this is the biggest fundamental driver for the $64bn ARR behemoth's 30%+ revenue growth that is likely to continue in the next few years.

Competition and the Future

The IaaS market has been highly consolidated with four major hyperscalers leading the game. The four spent $100bn combined in 2020 alone – an incredibly deep entry barrier for new players to take on.

Note that among top five players - AWS, Azure, GCP, Alibaba Cloud, IBM - only AWS and Alibaba Cloud [starting this quarter] report the pure IaaS revenue individually. Estimates differ but our general view is that AWS's market share has been well maintained as its net new ARR is still higher than others - for instance, its net new ARR this year is 2x+ that of GCP's.

Hyperscalers

Here we offer a brief analysis on the other three major hyperscalers.

Microsoft - Azure

Thanks to the "cloud first, mobile first" strategy ushered in by its first non-founder CEO Satya Nadella in 2012, MSFT quickly leveraged its soon-to-be-outdated enterprise Windows solutions and built an IaaS and SaaS business with huge scale very quickly. Its biggest edge comes from the huge existing client base that wants to shift to cloud seamlessly. Office 365 is the clearest example - people don't want to try another cloud productivity suite but keep using the existing office suite on a SaaS basis. The huge existing client base coupled with the speed at which MSFT has pivoted toward cloud services, makes it AWS’s most fierce competitor.

However, due to its entrenched lines of products, higher levels of bureaucracy, and less ambitious vision, we don't think Azure will overtake AWS. The relatively less ambitious vision can be illuminated under the context of custom chips - MSFT chose the FPGA route while AWS chose the tougher yet more rewarding custom-built route and we believe AWS’ moat will deepen as Graviton, Tranium and Inferentia chips continue to gain more adoption with 30% cost efficiency compared to COTS [commercial off-the-shelf] chips.

Google - Google Cloud Platform [GCP]

GOOGL was one of the earliest proposers of the notion called cloud. However, the company only jumped on the IaaS trend back in 2012. Even worse, its decision to appoint cofounder and former CEO of VMW was a huge disaster - the business remains marginal and there appear to be cultural headwinds. GOOGL also has made several strategic mistakes. GOOGL focused too much on PaaS solutions that are super innovative but have inherently higher transition costs and vendor lock-in fear for developers and organizations. It also cannot reconcile the mismatch between 80%+ margin ads business with great welfare and low margin IaaS business that requires a highly customer centric philosophy, 24/7 on call, cost control with fewer immediate benefits, and a tougher working environment compared to the core business overall. Contrasting GOOGL’s core business with that of AMZN’s highlights the latter’s advantage in having their core business as a retail-focused, consumer-facing operation. It’s clearly evident that AMZN’s retail culture and the notion of delivering the ’Amazon experience’ to every consumer has successfully been transferred to AWS. GOOGL, on the other hand, lacks that type of retail/consumer-facing business segment that cultivates such a customer-centric philosophy.

That being said, GOOGL has the most comprehensive sources of data - Search, YouTube, Tracker, Ads, Android, Gmail, G-suite, Chrome, etc. And its TPU [Tensor Processing Unit] and ML/AI capability is the strongest in the world. We expect GCP to remain marginal yet notable hyperscaler.

Alibaba - Alibaba Cloud

BABA is the Chinese twin of AMZN with lots of products copied from AWS. IaaS and the general as-a-Service business model isn't ideal for Chinese market due to high level of concentration. BABA in recent years found a great niche in contracting local and central government IT projects. This works more like Booz Allen [BAH] and Accenture [ACN] whereby the low touch benefit of aaS is reduced.

Thanks to lower labour cost and China’s great engineering talent pool, BABA is able to provide key technologies on par with AWS at lower costs and its GTM effort in frontier markets has been very successful. Its T-head custom chip unit is performing very well with numerous ML/AI, edge and Arm server chips introduced. Notably, its latest Yitian 710 is the state-of-the-art Arm chip first to use DDR5, PCI-e 5, and Neoverse N2. We expect BABA to continue to grow and solidify its top 3 hyperscaler status [and overtake GCP]. However, due to its lower revenue base and inability to break into core Western markets, we don't think it is going to hurt AWS anytime soon.

Alternatives

In light of the comparison with other hyperscalers, AWS's competitive edge is well secured. Here we outline several possible alternatives that could hurt AWS in the future, yet are less likely to stop AWS's 30% growth anytime soon.

Build your own data center. After the startups reach a certain scale, building your own or partially outsourcing the physical maintenance to colocation providers like Equinix is more economic. This is what DBX did beginning in 2016.

Hardware as a service provided by HPE's Green Lake, and Dell and Lenovo's comparative solutions. Instead of letting the middleman – the IaaS provider - to take more margin, enterprises can buy the hardware directly from the hardware vendor but priced by the consumption instead of heavy CAPEX.

Multi Cloud and Hybrid Cloud. Using multiple cloud providers at the same time, and ideally shifting the workload among various hyperscalers and proprietary data centers could better optimize cost and performance. The caveat is that aside from VMs, hyperscalers' products are getting more and more differentiated, especially as in the case of AWS.

Edge. NET’s and FSLY's script-based edge compute could bring in a new paradigm.

Conclusion

Based on our analysis in AWS's arena we believe there is no competitor now or in the future that could take down AWS on both cost and performance. There are competitors like Azure and alternative solutions that can limit AWS's market share. However, given the huge TAM and immense ubiquitous growth opportunities, we believe AWS' high growth will remain persistent for a few years.

Contrary to what the public believe, we found that AWS is highly differentiated and its gross margin could continue to go up as it moves further away from purely commoditized bare metal compute to delivering high value-added services to developers who need it badly.

By a quick calculation, AWS with an annualized run rate of $64bn, operating margin of 30%, expected 30%+ growth and persistent long-term growth, could be valued at more than $2.1tn – 2.4x higher than the top analyst estimate of AWS's value within AMZN. As such, we believe a melt-up scenario for AMZN could get kickstarted in the near future.

Anything discussed in this post should not be treated as investment advice. For further disclaimer and disclosure, always refer to Terms Of Use for Convequity Ltd.'s Research