Special Situation - VMW - When Will Investors See the Discount?

VMW has been long undervalued, but the multiple expansion seems imminent now.

Welcome to Covequity's Quick Takes1— Timely interpretation of news & special events for cybersecurity and enterprise tech investors. If you are new, you can join our email list here:

Sources of Alpha: Misinterpreted Events

Expected Price Appreciation: 100% from $110 within 3 years

Catalyst: Restructuring

Recommended Actions: Coming restructuring could see multiple expansion easily. Combined with stable long-term growth, and proper debt payout, VMW is a less risky, stable growth holding.

Executive Summary

VMW is a typical "good business with a bad financial structure".

Due to DELL's absolute 97% voting control, VMW has been trading at a huge EV/S discount relative to its lower growth, high margin legacy tech cohorts.

Various activist campaigns and Wall Street analysts have been actively selling the idea of restructuring to DELL.

In recent quarters, DELL finally agreed to make VMW independent and pave the way for multiple expansion.

What is VMW?

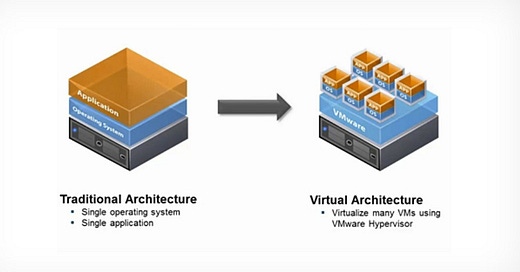

VMware is the inventor of virtualization technology that powers modern IT infrastructure we use today. Before VMW introduced ESXi hypervisor in 2001, each server blade was dedicated to one software application host only. This created some inefficiencies in capacity utilization. At one point of the time, software A may sit idle, resulting in the entirety of hardware A being in a state of 0% utilization. While software B may encounter peak demand, resulting in hardware B being in 110% over-utilization. However, as hardware is dedicated to the specific software, you can't allow hardware A to host software B during the peak hours. Furthermore, buying more servers will only result in more underutilization when software B sits idle as well.

With virtualization technology, the tight bonding of hardware and software is no longer needed. You can build up a giant server and slice resources into various Virtual Machines to host various software applications. Furthermore, you can allocate resources dynamically or on demand to ensure a consistent high utilization rate over time.

Pat Gelsinger and VMW's continued growth

VMW was later acquired by EMC, the storage giant, and later managed by the former INTC CTO turned EMC COO, Pat Gelsinger. Under Pat's leadership, VMW has continued to grow into various adjacencies.

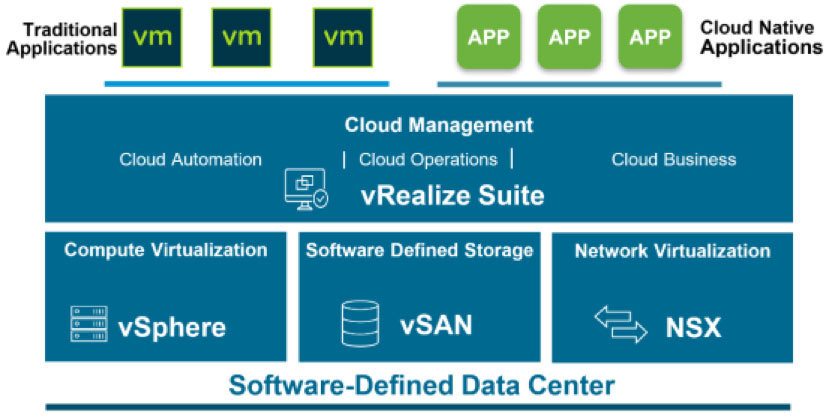

Most notably, the company acquired Network Virtualization startup Nicira for $1.26bn in 2012. The deal was believed to be overvalued but eventually Pat turned this into a 2bn+ business with huge profitability and gave VMW further strategic leverage within data centre infrastructure as network becomes the centre of the world. CSCO on the other hand, as a long time networking hardware vendor, found it hard to compete with VMW in the new world of Software Defined Networking.

Under Pat's leadership, VMW also successfully fought against MSFT's Hyper-V introduced in 2008 in an effort to smooth VMW out. The commercialization of VMW's core ESXi hypervisor business continued throughout the years, along with expanding the use of virtualization technology into adjacencies. In 2012, VMW coined a term Software Defined Data Centre. The idea is to use ESX to virtualize compute, NSX [Nicira] to virtualize networking, and vSAN to virtualize storage. vSphere is introduced to manage a cluster of ESX and vRealize Suite is developed to provide comprehensive management to the entire software-defined data centre components.

Multi-cloud and the future

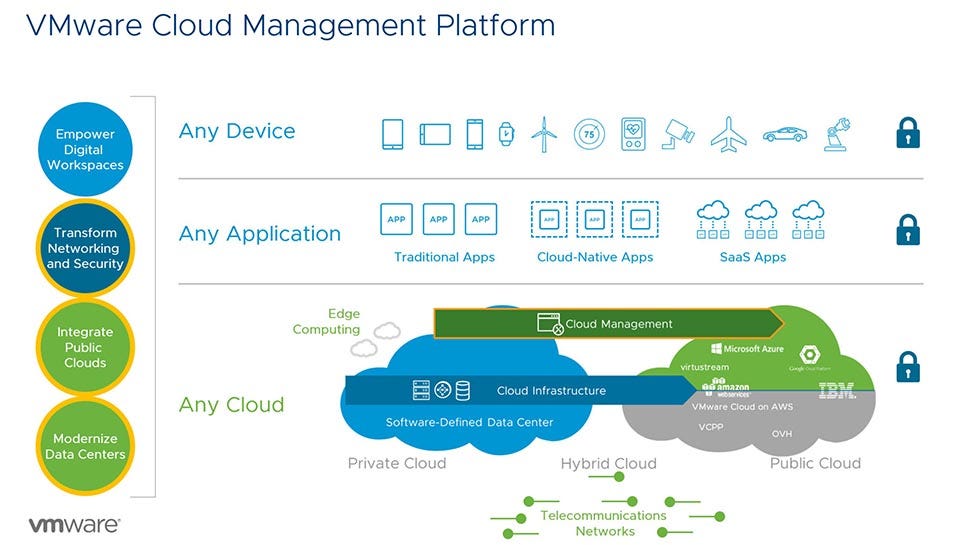

More recently, VMW centred its growth strategy around multi-cloud, container and cloud-native applications, and intrinsic security.

Multi-cloud is a huge market in the future as people hate vendor lock-in and VMW is primed to be the neutral vendor to help organize and be the new abstraction layer managing the underlying IaaS from AWS, Azure, GCP, AliCloud and others.

Containers and cloud-native applications are an ongoing movement that gained tremendous amounts of traction in recent years due to the proliferation of Kubernetes, microservices and DevOps mindsets. Containers allows software applications to be developed, managed and operated in a more efficient, resilient and high performant way. However, managing containers isn't easy. VMW's Cloud Foundry unit started with the project Tanzu very early on in 2016. The goal was to make container development and management simple and interoperable with existing ESXi hypervisor that manages the VMs.

Intrinsic security is another promising area where VMW could leverage its dominance in SDN. VMW acquired Carbon Black, a lesser growthy EDR vendor in 2019 to booster its security capabilities. The goal was to make data centre networking, which is largely managed by VMW's NSX SDN software, secured internally with micro-segmentation and various security inspection points enabled by default without the need to use and integrate third party solutions.

These stable business developments and revenue growth were done under the visionary leadership of Pat Gelsinger. Behind these great developments is the culture. Pat has successfully built up one of the best cultures in Silicon Valley with empowerment, flat management, and high creativity.

Poor financial structure creates a huge discount

The ownership, and the related financial governance has become increasingly tumultuous for VMW.

In 2016, VMW's parent company, EMC, was bought by DELL via a leveraged buyout [LBO] masterminded by Michael Dell and SilverLake, a well-renowned PE firm that has done many major tech LBOs. DELL spent $67bn for EMC, with $49bn coming from debt issuance.

With huge amounts of debt, DELL decided to keep VMW public via issuing a tracker matching the economic stake of VMW. Under this set up, public owners of VMW class A shares are expected to have the same economic ownership as Dell who owns 80% of the stock. DELL controls 100% of class B shares with 97% voting power in aggregate.

This set up has been detrimental to investors' confidence as DELL has the sole discretion over VMW's financial structure. VMW, as a $50bn market cap enterprise, cannot get into the buying list of major index funds due to the dual share class structure and lack of good governance. DELL also uses VMW's balance sheet to raise more debt, and leverage VMW's cash flow to pay down parent its own hefty debt load.

As a result, VMW's valuation has been highly suppressed and the share price has been trading at a 50%+ discount relative to other software companies with a c. 10% long term growth outlook and 30%+ EBITDA margin.

Several activist investors have been calling DELL to forfeit the control over VMW and unlock the true value of VMW. Most notably, Carl Icahn launched a fight against Michael Dell in 2018.

These various campaigns are deemed to fail as DELL has the absolute control. However, poor investor recognition also hurts DELL. After DELL goes public again [Dec-18], the stock has been trading at a steep discount similar to VMW due to governance concerns. Wall Street bankers have also suggested a cleaner structure could help unlock the value of both DELL and VMW.

Catalyst finally kicks in this year

In 1Q21, DELL finally decided to spin out VMW via distributing proportional VMW shares directly to DELL shareholders.

Round Rock, Texas-based Dell owns an 81 percent stake in VMware stemming from Dell’s acquisition of EMC in 2016. Dell will likely spin off its majority stake in VMware later this year to current Dell Technologies and VMware shareholders. Dell hopes the move will quickly boost its credit rating, achieve an investment grade rating, attract new investors, simplify its capital structure and potentially lower Dell’s debt stemming from the EMC acquisition via a special cash dividend.

“As both companies have stated, we believe a tax-free spin could drive shareholder, team member and customer value by simplifying capital structures and enabling flexibility,” Dell’s CEO Michael Dell told CRN earlier this year.

If all goes as planned, Dell will not spin off its shares of VMware before September 2021 for tax reasons. Dell is seeking to qualify the plan as tax-free for federal income tax purposes.

Finally, Dell is coming off a record fiscal 2021 that ran from January 2020 to January 2021. The company generated an all-time high of $94.2 billion in total sales, up 2 percent year over year, thanks to a surge in Dell’s Client Solutions Group -- which includes PCs, Chromebooks, notebooks, thin clients, printers, monitors and accompanying software and security – that reached a record $48.4 billion in sales.

Source: Why Dell’s Stock Price Is Climbing Towards $100 Per Share

Various hedge funds quickly traded on this upcoming restructuring. Combined with DELL's improving outlook in the IT infrastructure business, DELL's share price has steadily climbed with substantial multiple expansion.

VMW's share price and valuation, however, didn't melt-up in sync with DELL due to concerns around DELL's on-going control and specifics of the spin-off.

Per the spin-off design, VMW will pay a $27.40 special dividend to existing shareholders on 1st November, 2021. The total amount of the special dividend is $11.5bn with Dell's pro rata share of the dividend being $9.2bn. This huge dividend is financed by five unsecured senior notes issued in August 2021, totaling $6bn and an additional $4bn coming from term loan facilities.

Per the FAQ from VMW's IR, before the spin-off, DELL owns 80.5% of VMW with 97.4% of the voting power. After the spin-off, DELL's class B shares with super voting power will be converted to normal class A shares on a 1-to-1 basis. After the conversion, DELL will own approximately 41% of VMW and SilverLake will own 10%. Together, they will continue to have majority control over VMW. It should also be noted that Michael Dell is a LP investor of the SilverLake fund as well.

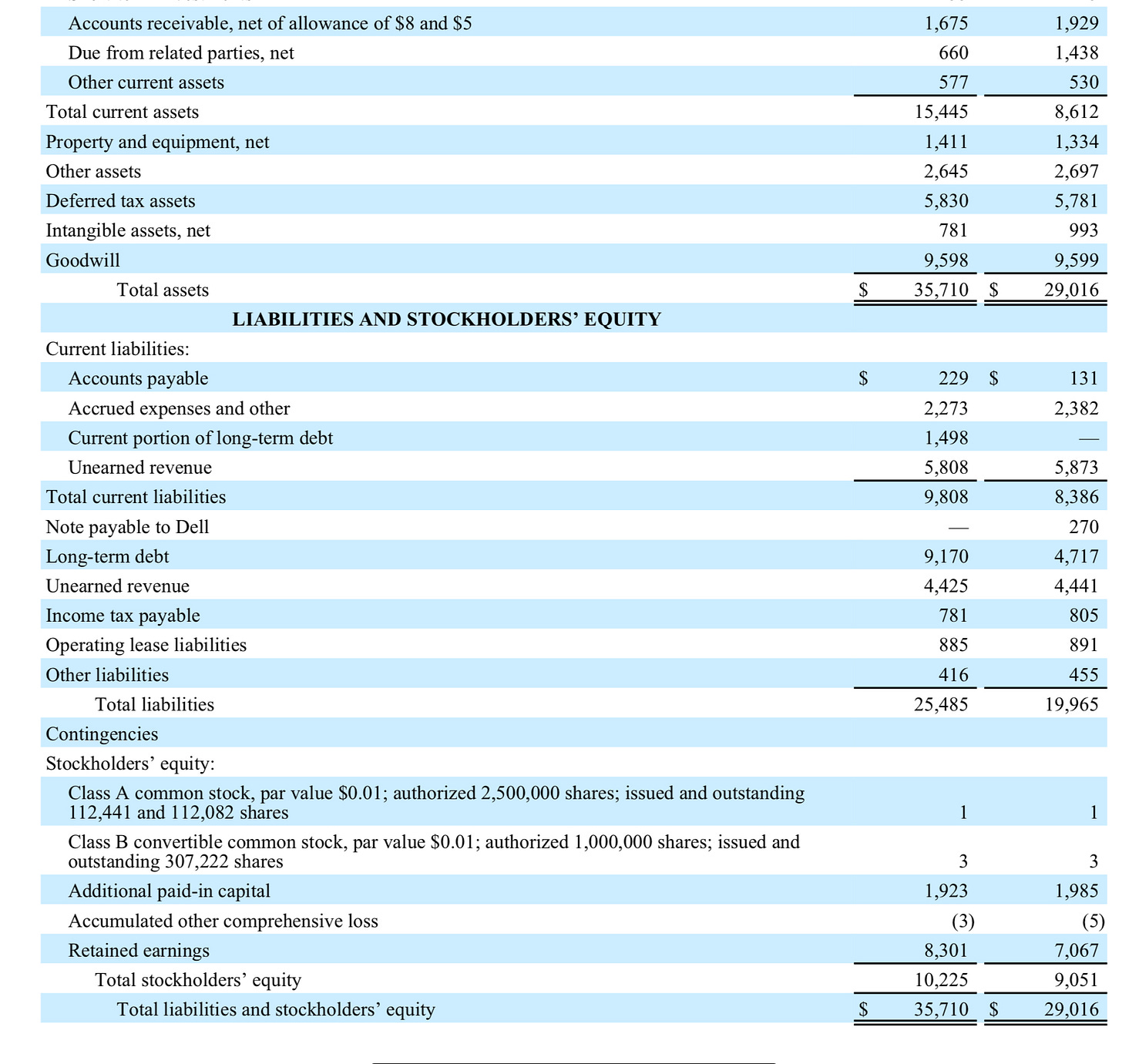

From the latest 3Q22 ER, the actual debt grew by $5.95bn, to reach a total of $10.7bn.

Forward expectation

Various neutral to bearish reports have cited this debt load to be super high and very detrimental to VMW's financial health going forward. The most prevalent narrative believes that the benefits of the spin-off heavily weigh in DELL's favour, and the special dividend is a ploy for DELL to milk VMW by as much as it can and pay down its high debt before losing total control.

Thus, VMW's share price has continued to slide, now reaching a 52-week low with EV/S LTM at 3.8x.

Source: Unhedged.com

We believe skepticism is partially warranted in that

DELL's control over VMW is still very substantial

The high debt load creates more risk

After the spin-off, VMW's management has gone through a tumultuous ride as well.

Furthermore, in Feb 2021, Pat Gelsinger went back to INTC as the new CEO. Pat was instrumental for VMW in managing a positive relationship with the controller Michael Dell while not losing VMW's technology independence, innovation, and trust to clients. Essentially, Pat is VMW's soul after its cofounders were fired back in 2008. Making things worse, similar to other tech executive turnovers, Pat brought his crews to INTC from VMW to ensure a smoother and more effective turnaround at semiconductor giant. Most notably, Pat hired VMW's CTO to be INTC's CTO, leading the transition of INTC to be more visionary in understanding software developers' demand and to deliver the software-defined chip promises.

Various VMW executives also left to explore other opportunities. In Dec 2020, COO Rajiv Ramaswami left VMW to be the CEO of NTNX, the creator of hyper-converged infrastructure who experienced years of low growth. In May 2021, COO Sanjay Poonen left VMW when he didn't get the CEO role.

The new CEO Raghu Raghuram, however, in our judgement, is as capable as Pat and highly qualified.

“The fact that we’re getting spun out of Dell, you can almost think of us as the Switzerland of multi-cloud,” said Raghuram in an interview with CRN. “We’re hardware agnostic, cloud agnostic and we can really focus on helping our customers run their applications and run their IT however they want to run it. We’re providing the tools to help them build new applications faster, run them across all of these locations, manage these applications, secure and protect them, etc. – that’s what we’re trying to do in a nutshell."

Raghu Rahuram Source: https://www.crn.com/slide-shows/virtualization/vmware-s-new-ceo-raghu-raghuram-8-big-things-to-know/

Raghu joined VMW in 2003 and has since led several key products including ESXi and vSphere. He is also the one who masterminded the Software-Defined Data Centre movement that brought VMW to the next level.

Our impression of him is that he shares many traits with Pat and he should be able to preserve and continue VMW's past success going forward. This is evidenced by his continued support for VMW's long-term strategic roadmap to become the "Switzerland of multi-cloud". Instead of competing head to head with hyperscalers with heavy capex and ruining the relationship with clients, VMW's multi-cloud strategy allows it to maximize its existing leadership in software and virtualization technology with its huge installed base. As cloud and digital transformation evolves, multi-cloud is the destined future as it further increases the efficiency gain.

VMW already has unquestioned dominance in SDN and VM. In the future, VMW can not only be the orchestrator for proprietary data centres, but also the higher level orchestrator for IaaS running on AWS, Azure, GCP, AliCloud and more.

There are three key challenges here:

Making a virtual network that connects various underlying infrastructure together that allows developers to treat them as if they are running on the same Ethernet.

Allowing applications to run everywhere without noticing the difference in the underlying infrastructure.

Ensuring developers have the best experience in dealing with cutting edge technologies like containers, Kubernetes, and cloud-native apps.

We believe VMW is primed and best fitted to solve these three challenges thanks to the visionary leadership who has been seeding the R&D for many years. Therefore, we believe VMW's growth should be able to be around 10% for the next few years and at high single digits in the longer term, as it keeps innovating and taking the leadership in important future fields.

On the DELL control, we believe it will be highly constrained in the future. Using VMW's cash flow to pay down DELL's LBO debt is now finished under the new structure. As investors have more time to evaluate the situation, we believe this could be good for long-term steady returns.

In regards to the debt load, this shouldn't be a huge concern. VMW is highly cash rich with $12bn in cash and equivalents. Its FY21 [ended 31st January, 2021] revenue stands at $11.7bn with a 30% EBITDA margin. Due to the nature of software and SaaS business, VMW also has clear visibility of future cash flow. Therefore, we believe this shouldn't be a huge risk factor for long term investors.

Valuation

DCF

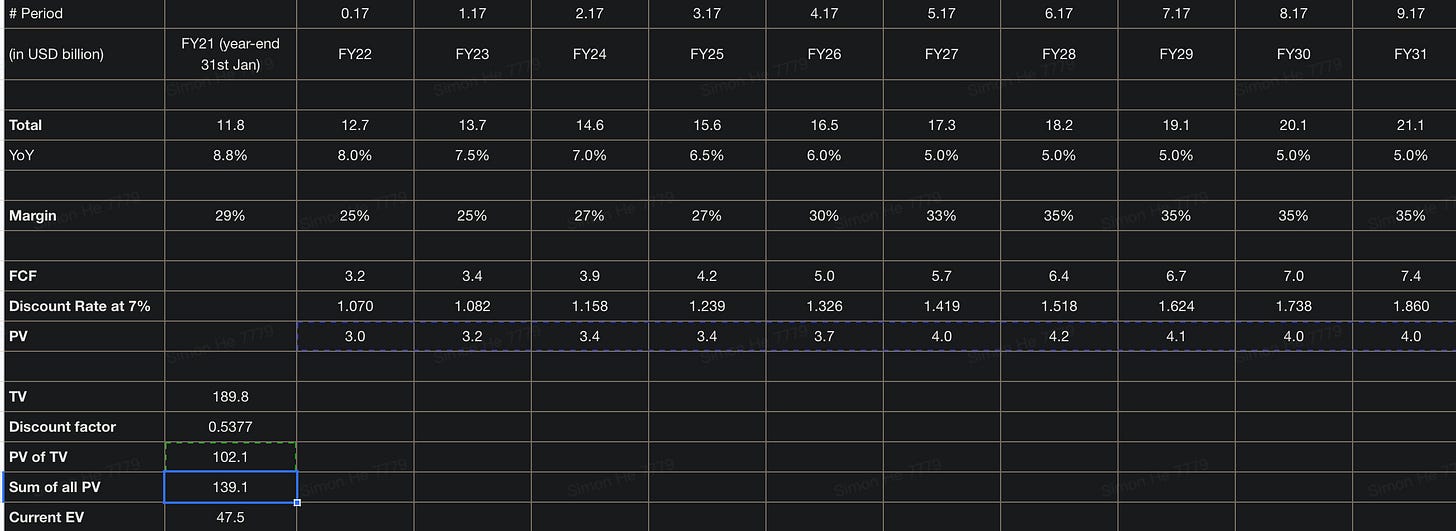

Our conservative DCF projects revenue growth to gradually decay from 8% to 5% and EBITDA margin to gradually come into 35% to match a typical rule of 40 for legacy tech companies.

This gives us a valuation at around $139bn, which is about 2.9x the current EV of $47.5bn. Not surprisingly, at $139bn, VMW's EV/S LTM is around 11x, similar to other legacy tech giants with bleaker outlooks.

To reaffirm our analysis, the risk factors limiting VMW's multiple expansion are:

DELL control

Recent management turnover

High debt

We believe these risks are highly concerning for investors without knowing the context. DELL is clearly executing the value-unlocking proposal design by investment bankers. We believe the interest is now aligned between investors and DELL as the latter is looking for VMW multiple expansion as well.

Furthermore, the most underappreicated point is VMW's long term growth potential. We don't think VMW is going to fade any time soon. Instead, it will be more and more important as the industry further develops.

Anything discussed in this post should not be treated as investment advice. For further disclaimer and disclosure, always refer to Terms Of Use for Convequity Ltd.'s Research